Back

28 Mar 2023

Crude Oil Futures: Extra gains are not favoured

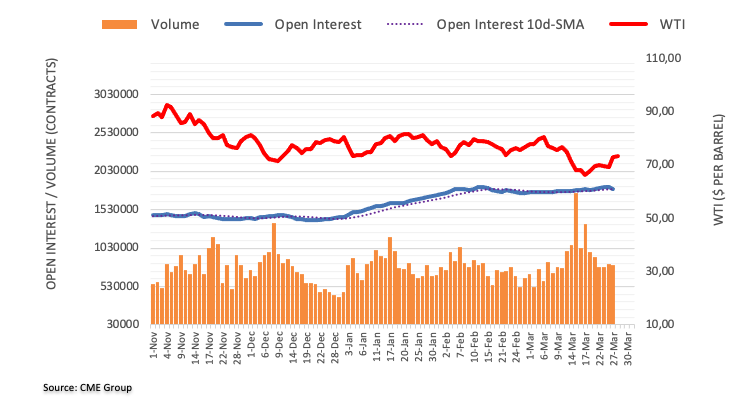

CME Group’s flash data for crude oil futures markets noted traders reduced their open interest positions by around 22.4K contracts after four consecutive daily builds on Monday. In the same line, volume remained choppy and dropped by around 13.6K contracts.

WTI: Next on the upside comes the 55-day SMA

Prices of the WTI rebounded strongly and closed above the key $70.00 mark per barrel at the beginning of the week. The uptick, however, was on the back of declining open interest and volume and is indicative that further upside is not favoured in the very near term. In the meantime, the next up barrier comes at the interim 55-day SMA, today at $76.28.