USD/JPY Price Analysis: Bears eye the weekly wick target

- USD/JPY bears eye a break of 4-hour support to encourage more offers.

- Bears eye the weekly wick and a firmer correction beyond.

USD/JPY is under pressure as the bullish rally starts to decelerate. The bears are in the market and eye a correction that targets the trendline supports as the following will illustrate.

USD/JPY weekly chart

The weekly charts show that the price was capped last week and has since deteriorated. The wick on the last week´s candle could be filled this week as follows:

USD/JPY daily chart

This leaves a bearish bias for the days ahead and the daily chart sees the price sandwiched between the support and the resistance line, currently.

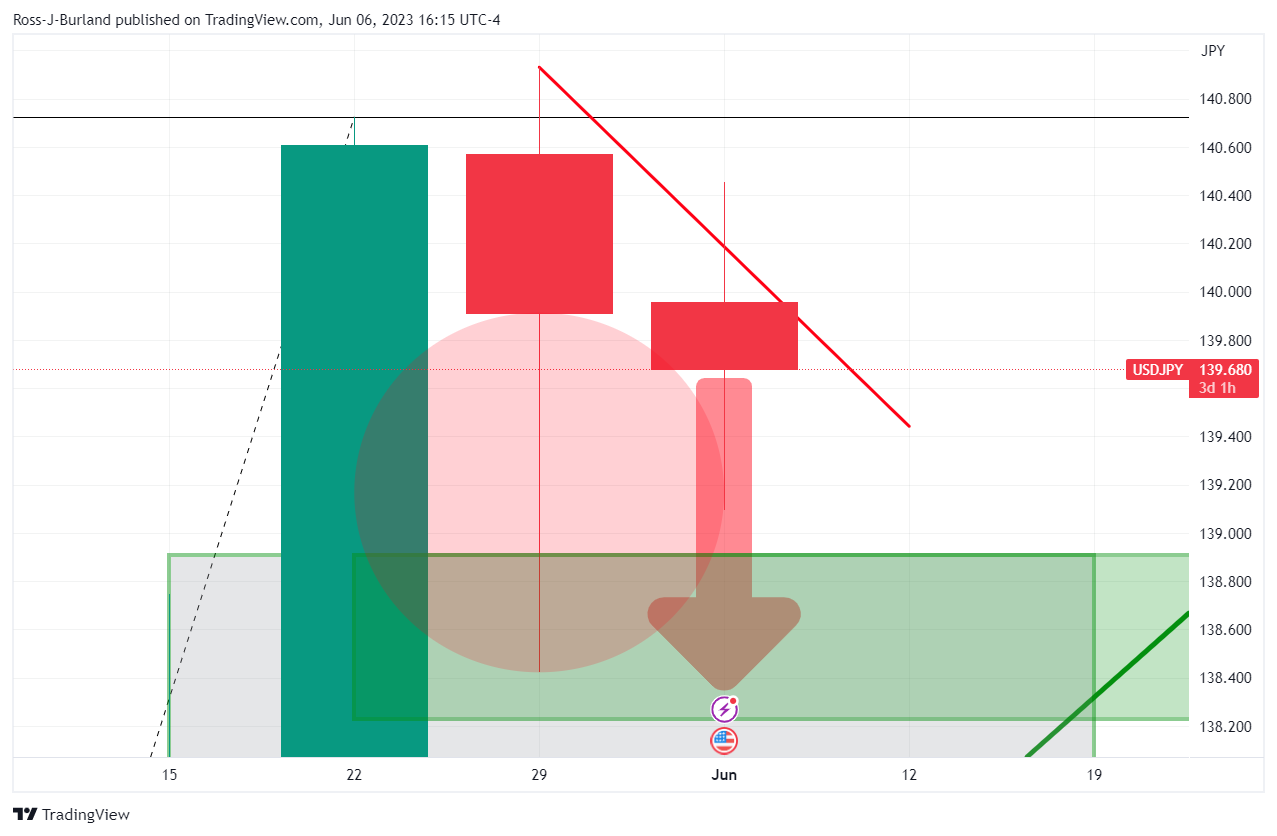

USD/JPY H4 chart

The Bears are flexing but need to do more. On the 4-hour chart, we can see prospects of a correction of the midday London spike. A move below support to target, say, the 61.8% Fibonacci could be encouraging and motivating the bears to commit below 139.70.