Back

28 Nov 2023

Crude Oil Futures: Extra downside on the table

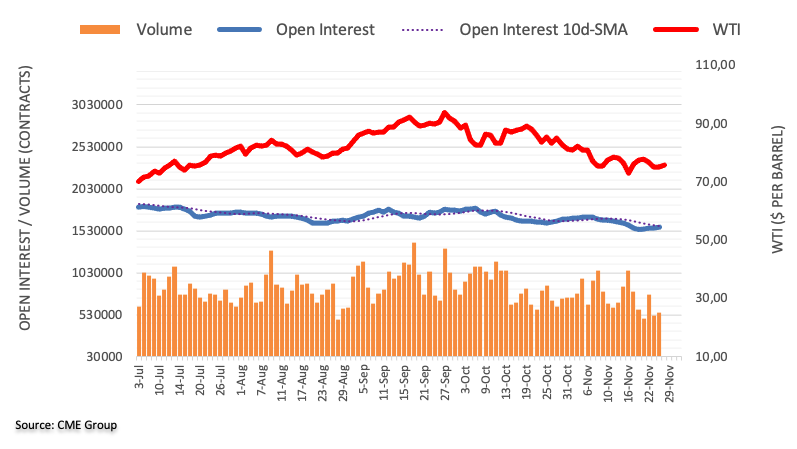

Open interest in crude oil futures markets increased for the fourth straight session at the beginning of the week, now by around 4.5K contracts. Volume followed suit and rose by around 41.5K contracts amidst the broad erratic performance seen as of late.

WTI: The 200-day SMA caps the upside so far

Prices of WTI kicked off the week in a negative fashion against the backdrop of rising open interest and volume. That said, further downside now emerges in the pipeline, with the commodity now risking a deeper pullback to, initially, the November low of $72.22 (November 16) in the very near term.