US Dollar sidelined around 97.70

The US Dollar Index – which tracks the buck vs. its main competitors – is posting marginal losses at the end of the week, currently hovering over the 97.70 region.

US Dollar attention to risk trends

The index is struggling to add gains to yesterday’s advance, coming down from highs in the boundaries of the 98.00 handle and attempting to stabilize around 97.70 ahead of the opening bell in Euroland

USD found some buying interest following the recent sharp sell-off, as the ‘Russia-gate’ effervescence appeared alleviated as of late. Geopolitical risks and tensions stemming from the Korean peninsula, however, stay on the rise and seem to be taking centre stage in the global markets today.

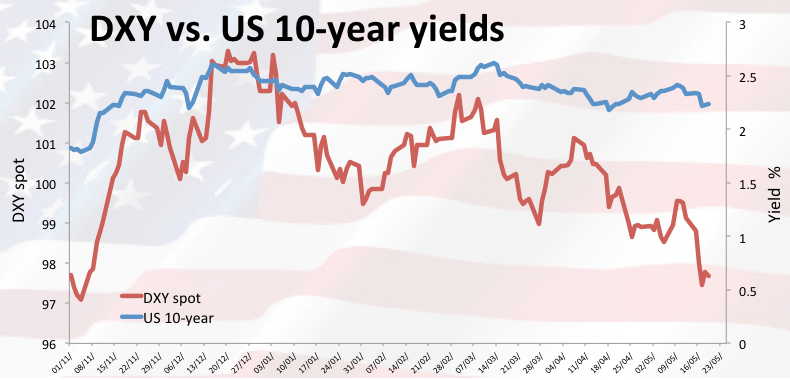

In the US money markets, yields have managed to rebound from monthly lows, with the 10-year reference approaching the 2.34% level after bottoming out around 2.18% on Thursday.

Empty docket in the US today should leave markets to the mercy of the risk appetite trends, while St. Louis Fed J.Bullard (2019 voter, centrist) is only due to speak later today.

US Dollar relevant levels

The index is retreating 0.08% at 97.69 and a break above 97.97 (high May 18) would open the door to 98.01 (high May 17) and finally 98.77 (high May 16). On the flip side, the immediate support aligns at 97.28 (2017 low May 17) followed by 96.94 (low Nov.4 2016) and then 95.91 (low Nov.9 2016).