Gold - Risk reversals add credence to spot rally, Vols rise

Gold prices rose to a 4-week high of $1257.18 in early Asia, tracking the weakness in the USD index and the Asian equities.

The metal has rallied more than 3% from the recent lows around $1210 levels, mainly on account of the sharp sell-off in the USD. The greenback continues to trade around 13-month low against a basket of major currencies as US political woes dampened hopes for quick passage of President Donald Trump's stimulus and tax reform agendas.

Risk reversals rise

The one-month 25 delta risk reversal is closely following the rise in gold prices, suggesting investors see the rally as sustainable. Rising risk reversals is the result of the falling demand for downside protection (put option).

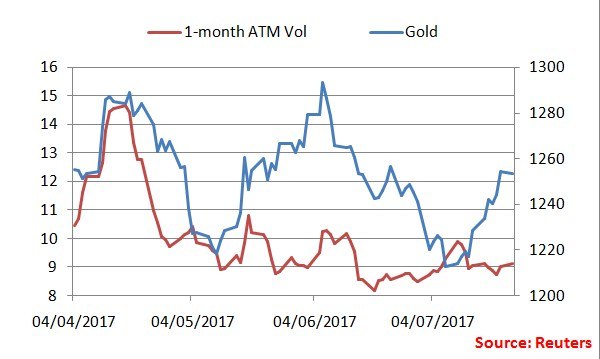

The one-month ATM volatility is showing signs of life as well. Vol is back at levels last seen a week ago (9.13).

Gold set to extend the rally

The combination of the rising risk reversal and ATM volatility indicates the gold rally is here to stay. On the higher side, the key levels to watch out for are $1261/1274.