GBP/USD drop to 8-week low, Risk Reversal and Bond yield spread warrants caution

GBP/USD finally breached the 50-DMA to the downside in a convincing manner on Tuesday and extended losses in Asia to an 8-week low of 1.2805 levels. The downside break of the recent trading range of 1.2830-1.2920 marks the continuation of the sell-off from the recent high of 1.3268.

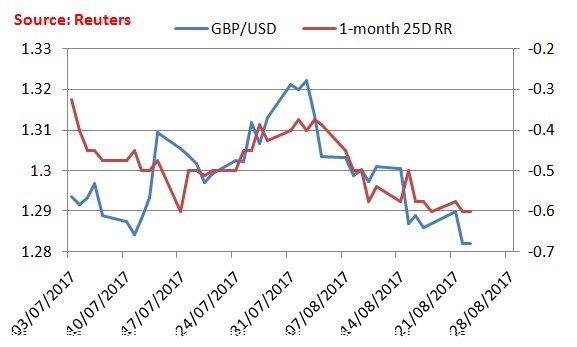

However, the one-month 25-delta risk reversal remained unchanged at -0.60 on Tuesday, which means the demand for Puts did not increase despite the downside break of the trading range.

Furthermore, the US-UK 10-year yield spread remains stuck in a falling channel pattern. Thus, bears need to observe caution.

A technical breakdown would look more convincing if accompanied by an upside break on the yield spread chart and drop in the risk reversal below -0.60 [that would be lowest since June 26].

GBP/USD Technical Levels

Valeria Bednarik, Chief Analyst at FXStreet, writes, “from a technical point of view, the downside remains favored, given that in the 4 hours chart, the 20 SMA began gaining downward momentum above the current level, whilst technical indicators hold within bearish territory, with the RSI indicator already gyrating south around 35. A bearish extension through 1.2810 should favor an approach to the 1.2700/20 region, where the pair presents multiple relevant daily highs and lows from earlier this year.”