GBP/JPY: The Guppy is trapped in a range ahead of key Brexit event

- Brexit uncertainties weigh on the British Pound.

- Yen is gaining some strength as CPI numbers are expected to continue growing.

The GBP/JPY is currently trading slightly down at around 149.10 or - 0.13% moving within the tight range as the Federal Reserve Chairman Congressional testimony sees US Dollar rising across the board against majors. Market participants are likely waiting for more information regarding the Brexit before making any decisions as to which path the GBP/JPY will take in the medium term. The GBP/JPY seems to be supported for now at the 149.00 handle.

The key Brexit event is scheduled for Wednesday, February 28, 2018, with the European Union publishing a draft Brexit withdrawal treaty that is set to be very explosive ignoring Theresa May’s recent requests about the transition and risks prompting a domestic crisis over the sensitive issue of the Irish border.

The pound decreased in value as the EU chief Brexit negotiator Michel Barnier said that extending the Brexit transition period beyond 2020 was not a possibility.

For the Japanese Yen, retail trade and industrial production numbers are coming up later on Tuesday at 23.30 GMT.

The Japanese Economy Minister Motegi said on Tuesday that he was expecting CPI numbers to continue their steady growth which is seen as bullish for Yen investors.

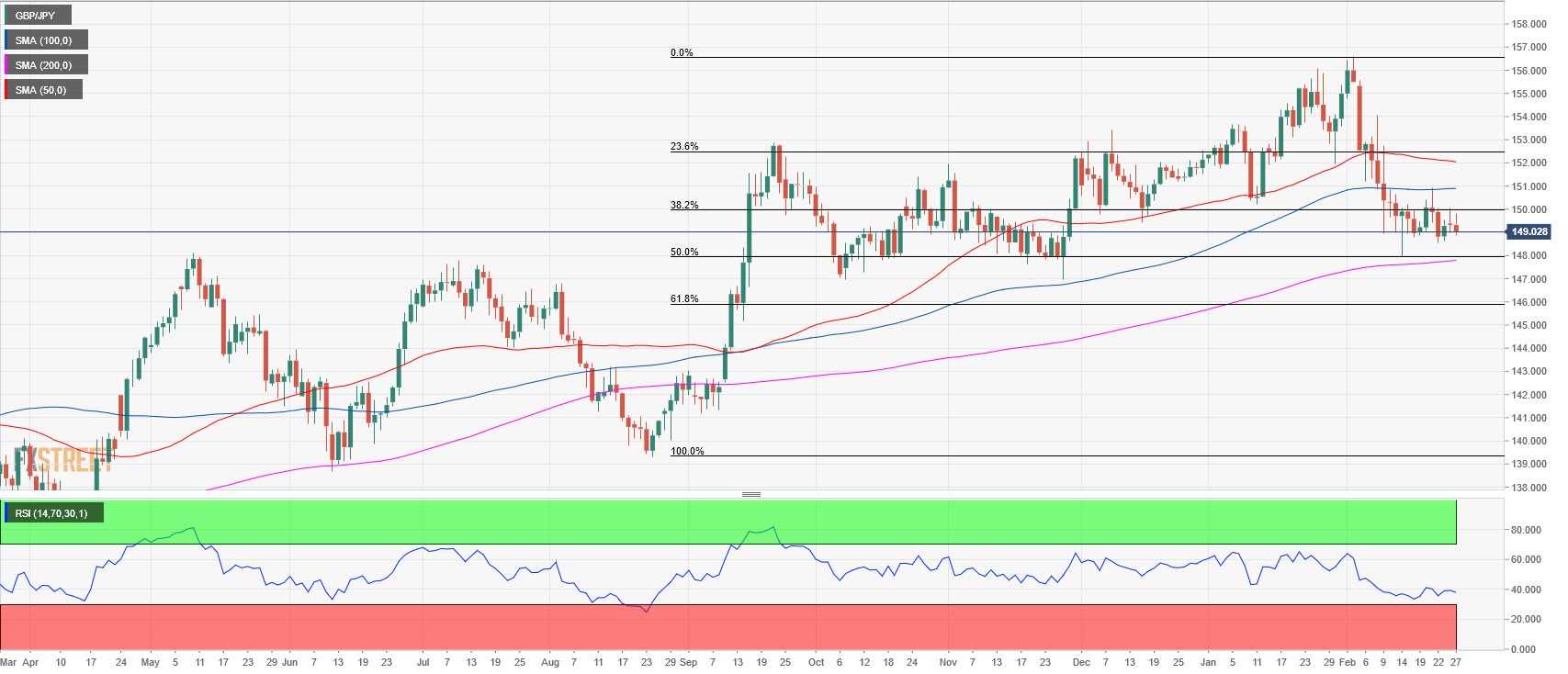

The GBP/JPY is trading in the 149.00-150.00 tight range. To the downside, the next support is the 148.00 level which is the cyclical low and also 20 pips away from the 200-period SMA on the daily chart. Further down the 146.00 level is the 61.8% Fibonacci retracement from the August 2017-February 2018 bull run. To the upside, resistance is seen at 151.00 figure in conjunction with 100-period SMA on the daily chart. The next key resistance is seen at the 152.00 figure which is a confluence zone with the 50-period SMA on the daily chart and the 23.6% Fibonacci retracement from the August 2017-February 2018 bull run.

GBP/JPY daily chart