USD/RUB flirting with 4-week tops near 57.30

- RUB depreciates further following UK-Russia political jitters.

- The pair advances to fresh multi-week tops in the 57.30 region.

- Russian GDP, Trade Balance figures surprised to the upside recently.

The Russian Ruble is losing further ground vs. its American peer on Thursday, lifting USD/RUB to fresh 4-week peaks in the 57.25/30 band.

USD/RUB higher as political jitters prevail

RUB is falling further today as the effervescence around the recent UK-Russia incident continue to grow bigger. Adding to the political concerns, France, US and Germany are now demanding Russia to explain the recent attacks in the UK.

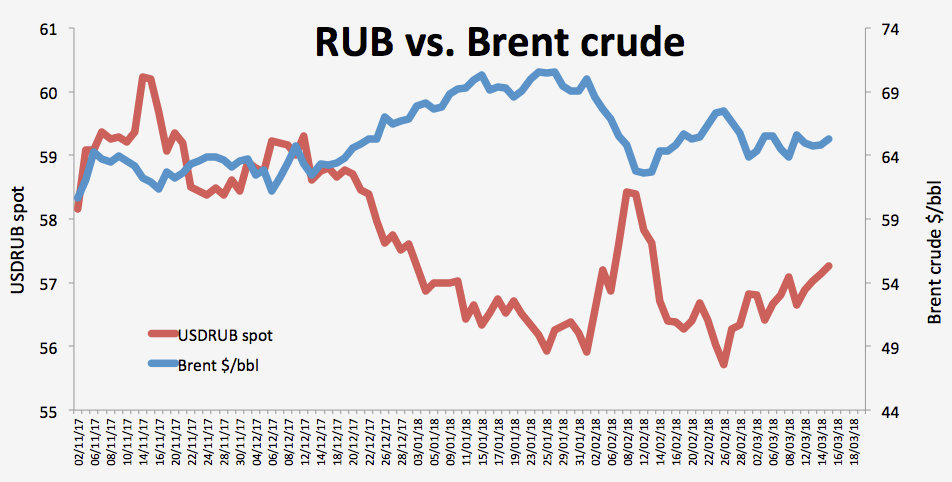

RUB stays under pressure nonetheless, as the likelihood of further US sanctions against the country never ceased to linger while the recent softness around the barrel of the European reference Brent crude has been also adding to the downbeat mood around the Russian currency.

In the data space, RUB ignored auspicious results from the Russian docket, where GDP figures published on Wednesday showed the economy expanded at an annualized 2.0% during January and the trade surplus widened to RUB 16.99 billion during the same period, both prints surpassing prior surveys.

Today’s results in the US docket plus rising risk-off sentiment are supporting the buck and therefore adding to the pair’s upside, which is up for the fourth consecutive session and recording fresh multi-week peaks.

USD/RUB levels to watch

At the moment the pair is up 0.32% at 57.32 and a break above 57.69 (100-day sma) would aim for 58.14 (200-day sma) and finally 58.75 (2018 high Feb.9). On the other hand, the next support is located at 56.85 (10-day sma) followed by 56.26 (low Mar.6) and then 55.56 (2018 low Feb.27).