CAD/CHF flirting with the 0.75 handle as bulls take control

- Inflation data from Switzerland is slated on Thursday at 7:15 GMT.

- The CAD/CHF momentum has shifted to bull after the 0.7430 was broken to the upside.

The CAD/CHF is trading at around 0.7489 up 1.3% on Tuesday as fears of trade wars between China and the United States are slowly wearing off for the time being with the CAD benefitting from return of the risk-on mood.

While Swiss franc fell to 10-day low against the US Dollar on Tuesday losing 0.4% on the day, the Canadian Dollar ganed more than 1% against the US counterpart.

Looking ahead, inflation data in Switzerland is scheduled on Thursday at 7:15 GMT with the Consumer Price Index (CPI) expected to remain unchanged at 0.6% year-on-year in March, while the month-on-month reading in March is expected to decelerate to 0.3% from 0.4% the previous month.

Earlier in the European session, real retail sales in Switzerland, year-on-year to February came in better than expected at -0.2% against -0.7% forecast; it increased from previous readings in January seen at -0.4%. Still, in Switzerland, the SVME Manufacturing Purchasing Managers Index (PMI) fell from 65.5 in February to 60.3 in March while analysts forecast 64.3.

Earlier in the week on Monday, the Canadian Markit Manufacturing PMI in March matched analysts’ expectation at 55.7

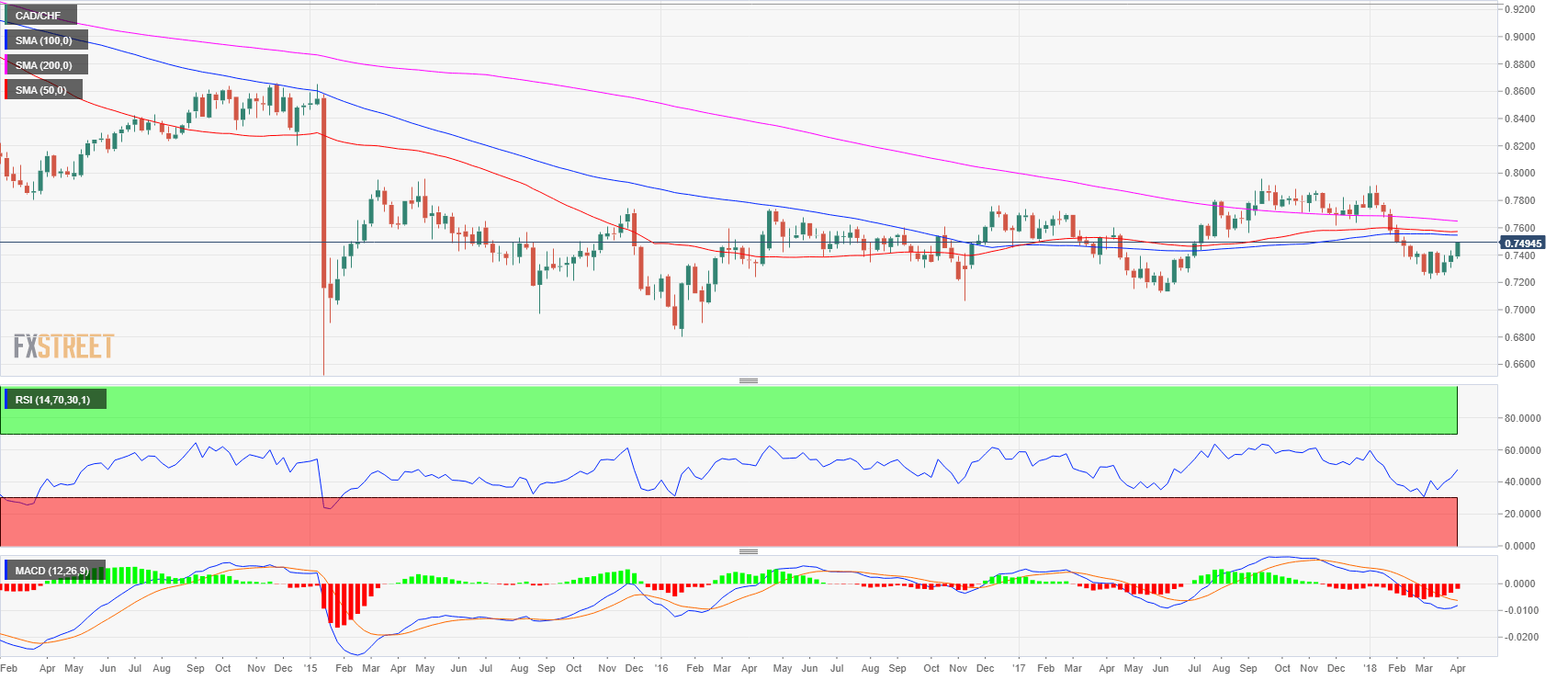

CAD/CHF weekly chart

The CAD/CHF has broken above the 0.7430 key resistance confirming the bull momentum in the cross. The next resistance ahead is seen at the 0.76 handle previous swing low and 0.78 figure. The 0.7430 now becomes the support to watch.

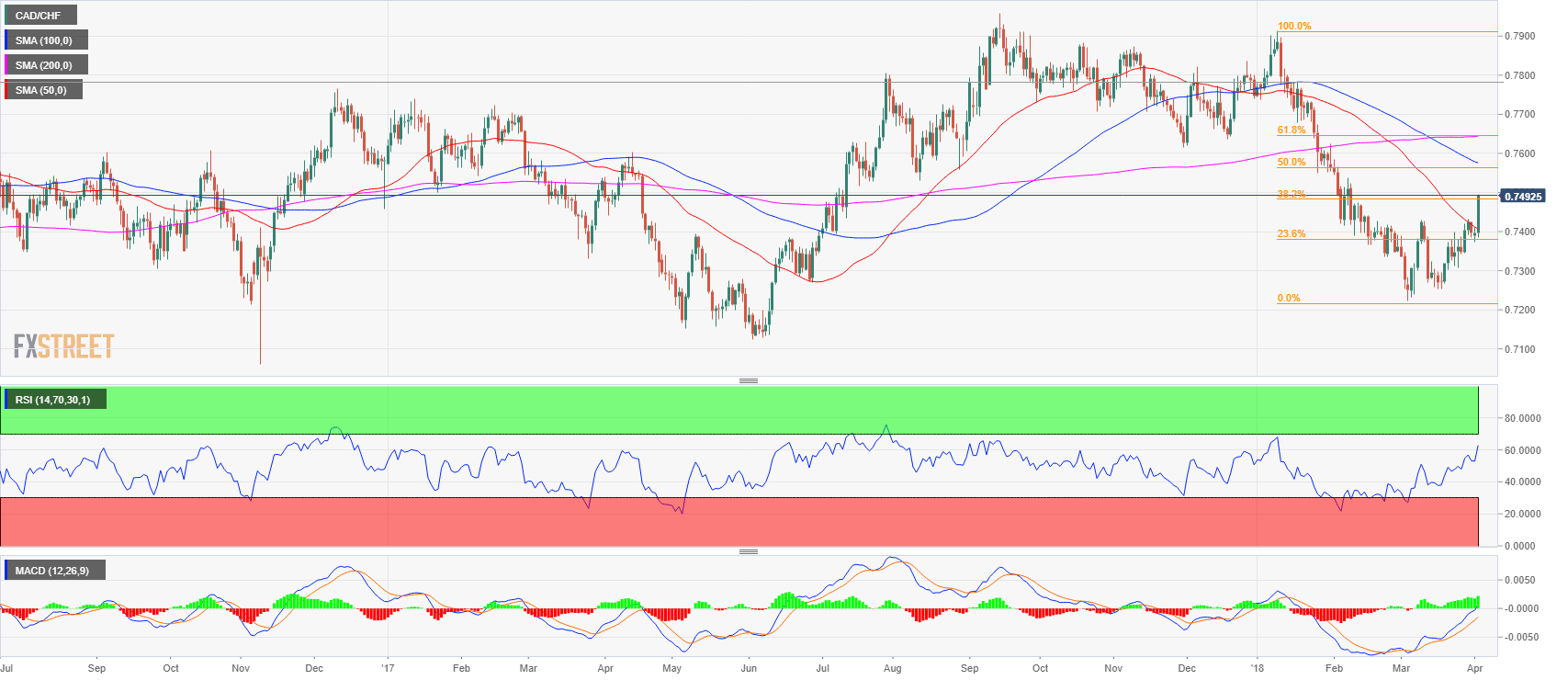

CAD/CHF daily chart

The CAD/CHF cross broke above the 50-period simple moving average and is currently flirting with the 0.75 figure. The 0.75 handle in conjunction with the 38.2% Fibonacci retracement will provide resistance. Looking further up, the 0.7560-0.76 zone will provide resistance as both the 100 and 200-period simple moving average coupled with the 50% and 61.8% Fibonacci retracement level are all seen near the resistance area.