USD/JPY weaker around 107.20, US data eyed

- The pair stays on the defensive, keeps the trade above 107.00.

- US 10-year yields rose to tops beyond 2.86%.

- US Retail Sales, Empire State index and Fedspeakers on the docket.

The greenback has started the week on a soft fashion vs. its Japanese counterpart on Monday, with USD/JPY navigating the area around 107.20.

USD/JPY looks to US docket

After two consecutive sessions with gains, the pair is now correcting lower following Friday’s doji-like candle and a generalized selling bias hitting the buck. The pair, however, manages well so far to keep business above the key 107.00 milestone.

Shrinking geopolitical and trade concerns motivated JPY sellers to return to the markets in past weeks, lifting spot beyond 107.00 the figure. The pair, however, remains vulnerable to further downside in case fears of a US-China trade war resurface along with effervescence in the Middle East.

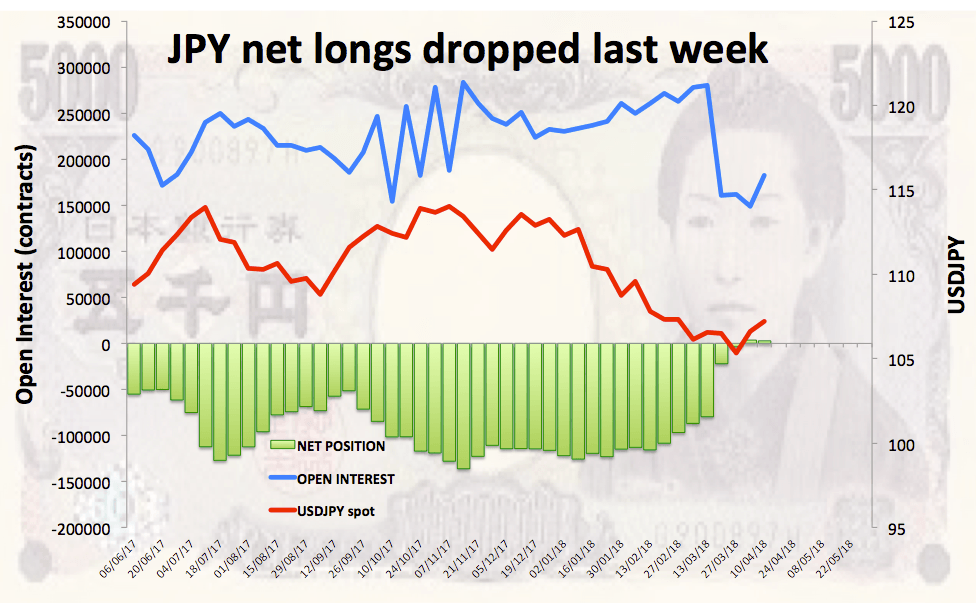

News from the speculative community noted JPY net longs receded to 2-week lows on the week to April 10, as per the latest CFTC report.

Later in the day, US Retail Sales will take centre stage followed by the regional manufacturing gauge from the Empire State Index and second-tier publications like the NABH index and TIC Flows.

Additionally, Dallas Fed R.Kaplan (non voter, hawkish), Minneapolis Fed N.Kahkari (non voter, dovish) and Atlanta Fed R.Bostic (voter, centrist) are all due to speak later in the NA session.

USD/JPY levels to consider

As of writing the pair is retreating 0.15% at 107.25 facing the next down barrier at 107.04 (10-day sma) followed by 106.61 (low Apr.9) and finally 106.44 (21-day sma). On the upside, a break above 107.78 (high Apr.13) would aim for 107.92 (high Feb.21) and then 110.48 (high Feb.2).