EUR/USD clinches fresh tops near 1.2370, US data on sight

- Further USD-weakness is propping up the bull run to 1.2370.

- DXY threatens to re-visit recent lows in the 89.60/50 band.

- US Retail Sales and Empire State index in the limelight later in the day.

A fresh wave of selling pressure around the greenback is now sustaining the up move in EUR/USD to fresh daily highs in the 1.2360/70 band.

EUR/USD looks to US data for direction

Following Friday’s doji candle, the pair is now gathering further upside traction and is testing the upper end of the daily range in the 1.2360/70 band, always on the back of a renewed wave of USD-selling.

Spot, however, remains entrenched within the broader 1.2155/1.2555 range that has been in play since late January and waiting at the same time for a strong-enough catalyst to break the consolidative theme in any direction.

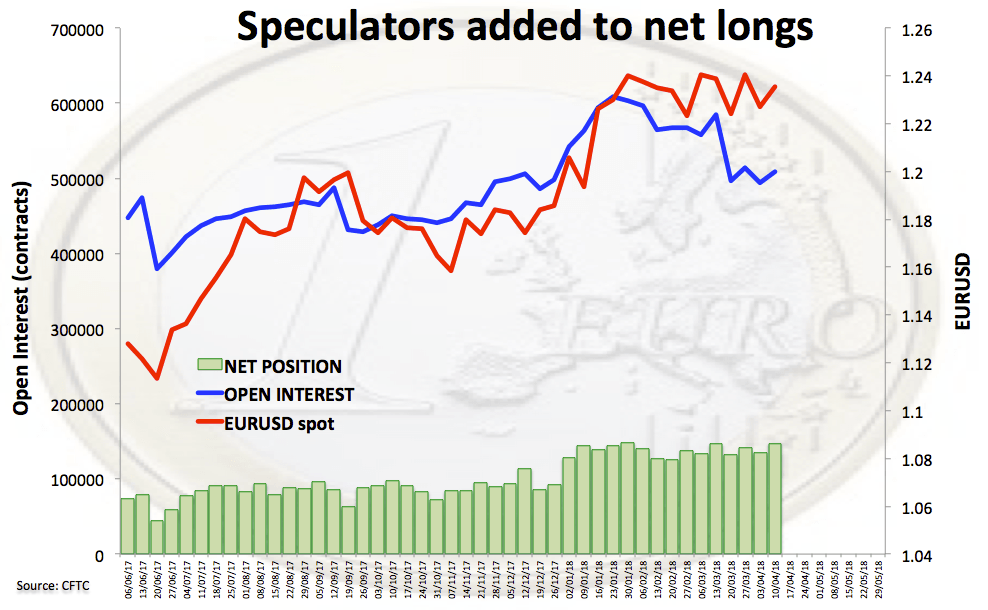

On the positioning front, EUR speculative net longs climbed to the highest level since January 30 in the week ended on April 10, according to the latest CFTC report.

Looking ahead, US Retail Sales for the month of March are due along with the Empire State Index for the month of April, TIC Flows and the NAHB index.

Further out, attention will also be on speeches by Dallas Fed R.Kaplan (non voter, hawkish), Minneapolis Fed N.Kahkari (non voter, dovish) and Atlanta Fed R.Bostic (voter, centrist).

EUR/USD levels to watch

At the moment, the pair is gaining 0.24% at 1.2359 facing the immediate resistance at 1.2397 (high Apr.11) followed by 1.2478 (high Mar.27) and then 1.2538 (high Jan.25). On the downside, a breakdown of 1.2300 (low Apr.12) would target 1.2214 (low Apr.6) en route to 1.2153 (low Mar.1).