Crude Oil WTI Technical Analysis: Worst daily decline since mid-July

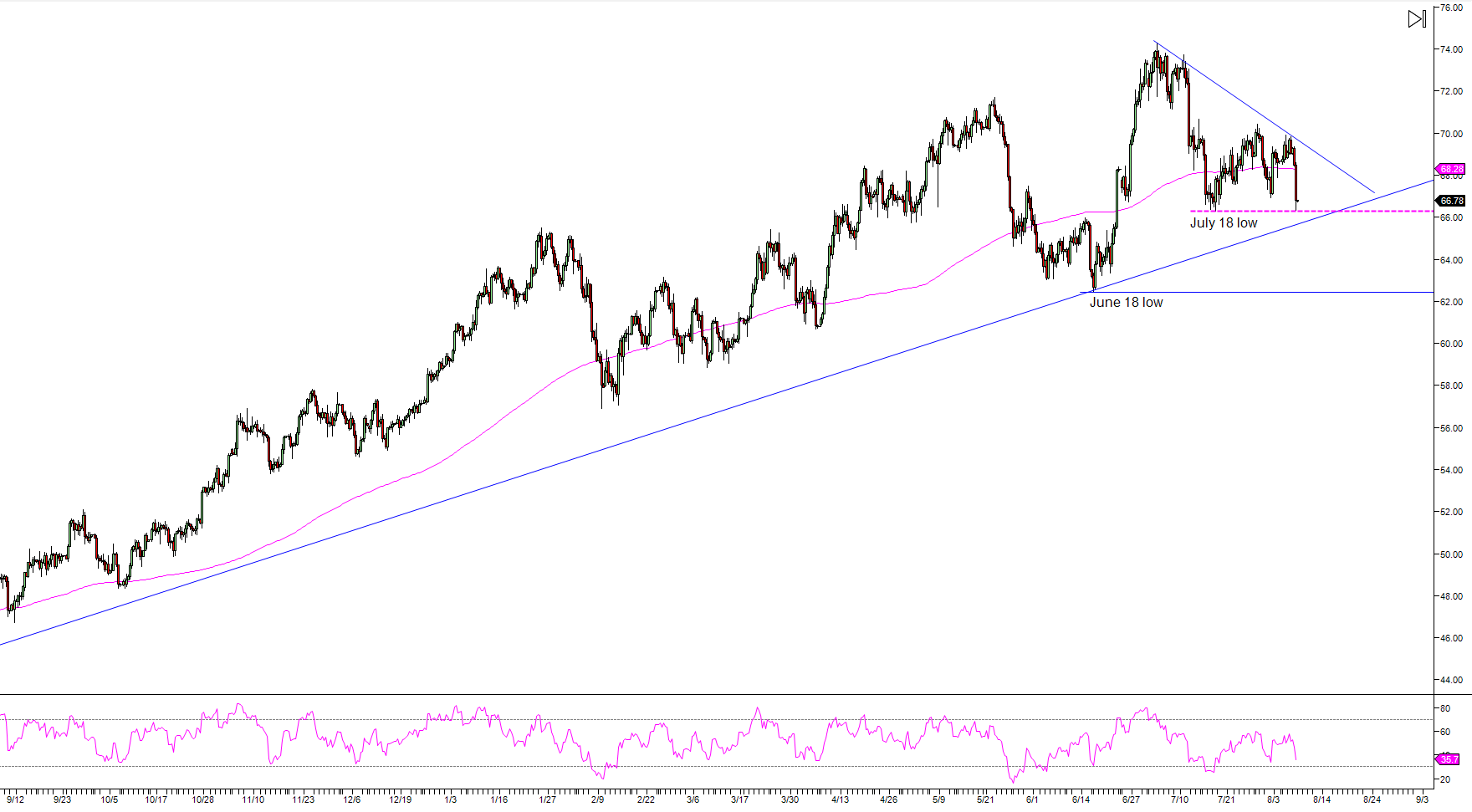

- Crude oil melted about $2.5 this Wednesday as it broke below the $67.00 psychological level and the swing low at $66.92 a barrel. This is the worst daily decline since July 16.

- Bears objective is to breakout below 66.30, July 18 low in order to open the gates towards June 18 low at 62.74.

- Crude oil bulls objective is to create a double bottom with July 18 low at 66.30. While in the short-term bulls have a fair chance to support the market, it remains to be seen how long they can sustain it. As of now, the overall picture suggests that a break below 66.30 is virtually bound to happen at some point.

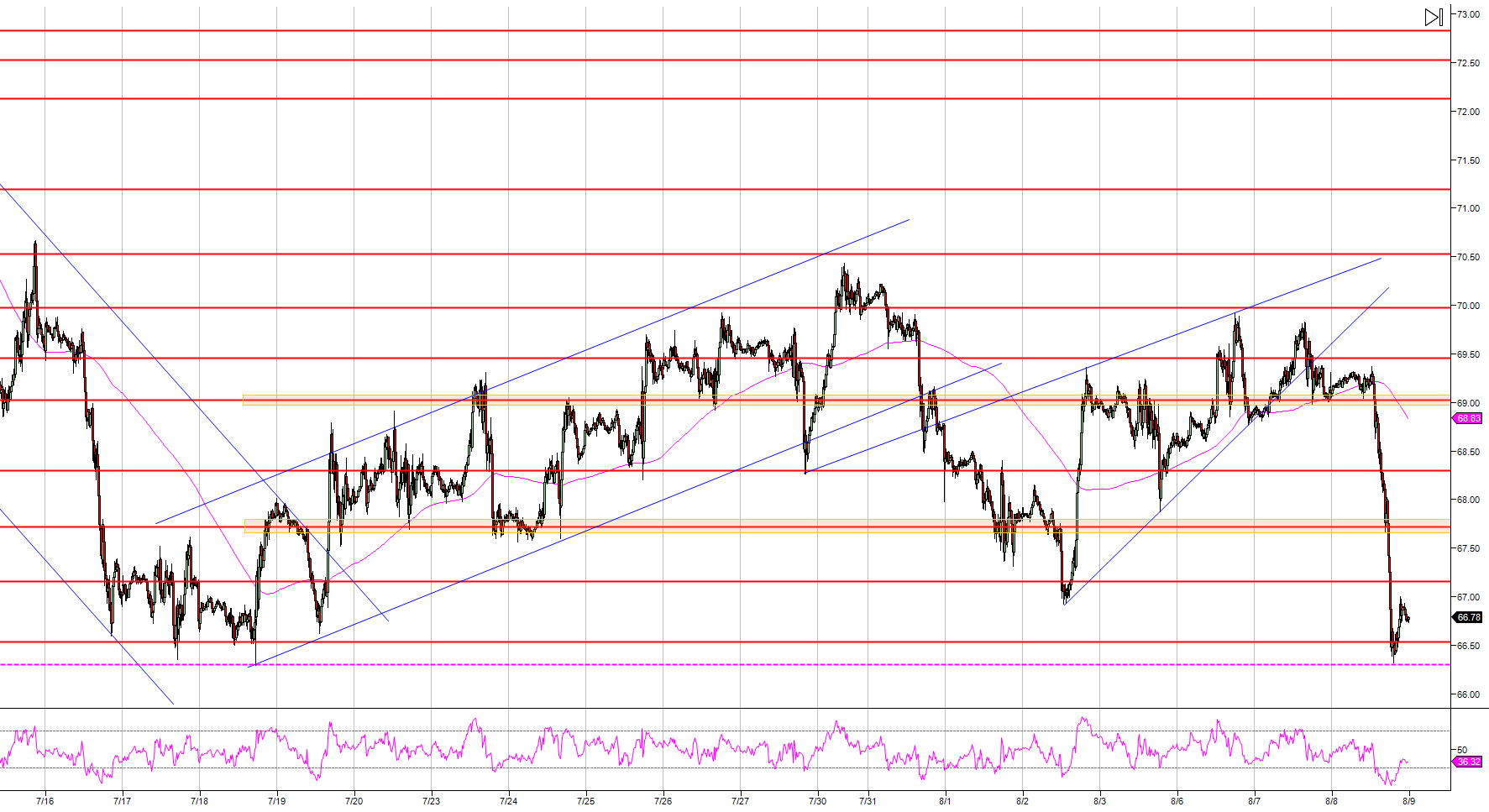

Crude oil 15-minute chart

Crude oil 480-minute chart

Spot rate: 66.69

Relative change: -3.53%

High: 69.34

Low: 66.29

Main Trend: Bullish

Short-term: Bearish reversal below 66.30

Resistance 1: 67.16 June 14 high

Resistance 2: 67.16 June 14 high

Resistance 3: 67.72 June 26 low

Resistance 4: 68.30 supply/demand level

Resistance 5: 69.00 figure

Resistance 6: 69.44 June 25 high

Resistance 7: 70.00 figure

Resistance 8: 70.53 May 24 low

Resistance 9: 71.19 May 23 low

Resistance 10: 72.13 July 6 low

Resistance 11: 73.00 figure

Support 1: 66.30-66.53 July 18 swing low and June 20 high

Support 2: 65.71, June 22 low

Support 3: 65.00 figure