Back

9 Aug 2018

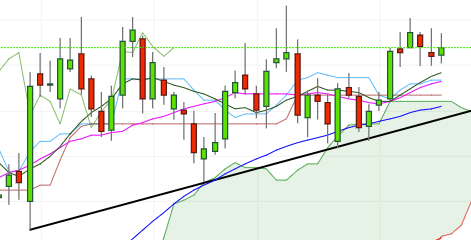

DXY Technical Analysis: Constructive outlook persists above the support line at 94.40

- The greenback has returned to the positive territory in the second half of the week, always managing well to keep business above the psychological 95.00 handle.

- Prospects for further upside remain intact while above the short-term support line, today around 94.40. This idea is reinforced as long as DXY trades above the daily cloud.

- If we look to the opposite direction, sellers met a strong hurdle in the 95.00 neighbourhood so far. In addition, the 10-day SMA at 94.93 also adds strength to this area of contention.

- A breakout of the critical 95.50 level should pave the way for a test of YTD peaks in the 95.60/65 band ahead of the 50% Fibo retracement of the 2017-2018 drop at 96.04.

DXY daily chart

Daily high: 95.34

Daily low: 95.03

Support Levels

S1: 94.93

S2: 94.74

S3: 94.50

Resistance Levels

R1: 95.36

R2: 95.60

R3: 95.79