S&P500 Technical Analysis: US Stocks on a bull run break above 2,730.00 level

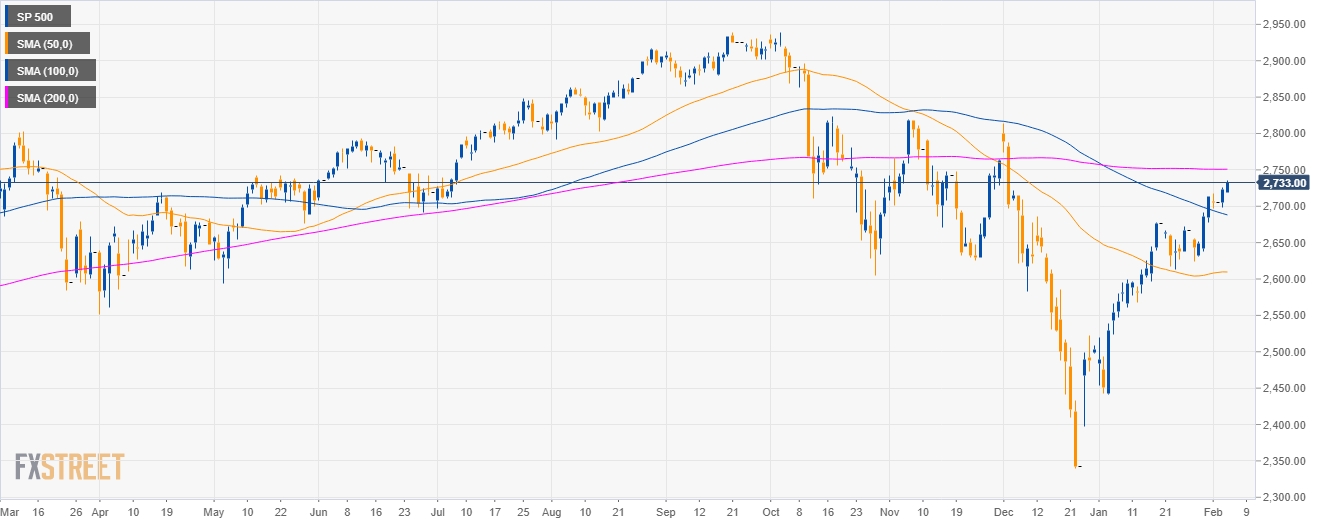

S&P500 daily chart

- The S&P500 Index is having a strong bullish recovery after the deep pullback below the 200-day simple moving average (SMA).

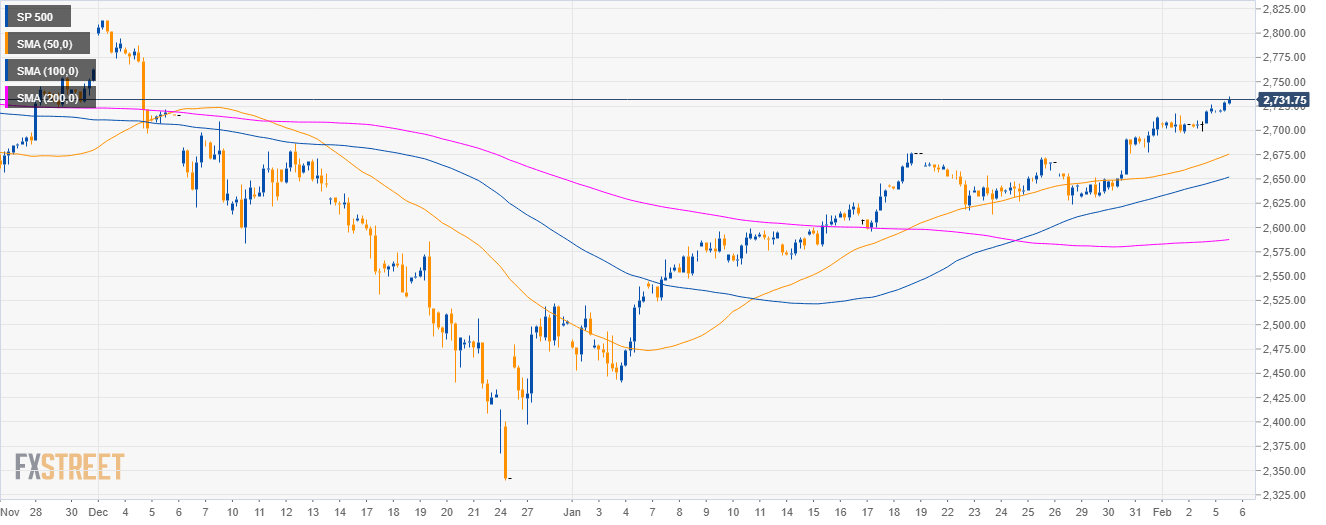

S&P500 4-hour chart

- The S&P500 is trading above the 50, 100 and 200 SMAs suggesting a bullish bias in the medium-term.

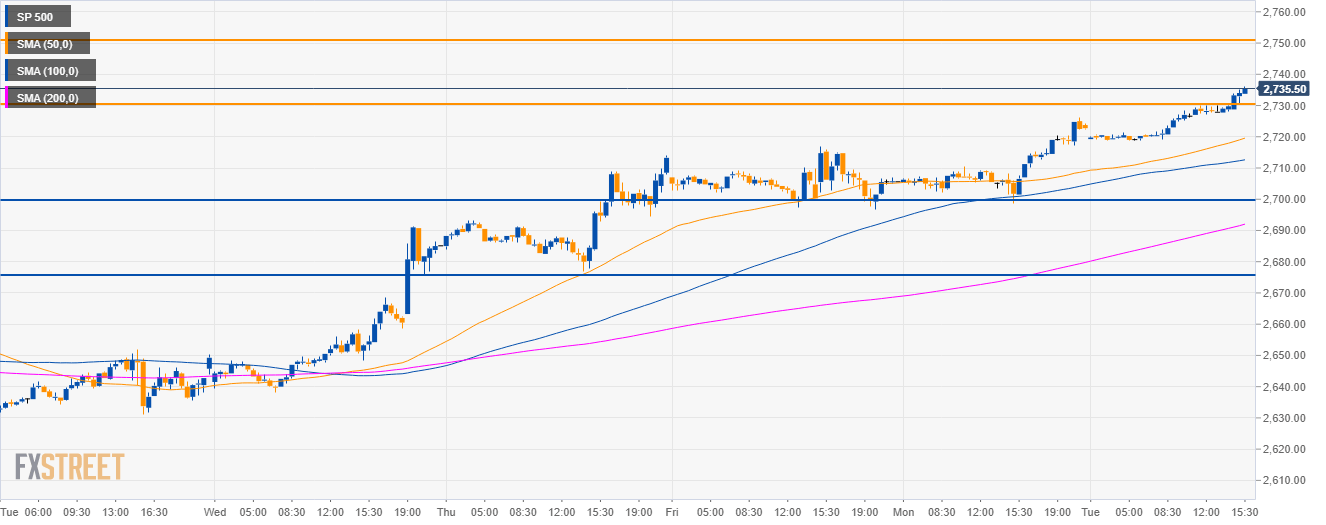

S&P500 30-minute chart

- The S&P500 is trading above its main SMAs suggesting bullish momentum.

- The market is breaking above the 2,730.00 resistance. The next objective will likely be 2,750.00 and 2,800.00 levels to the upside.

- To the downside, support can be expected at the 2,700.00 and 2,655.00 levels.

Additional key levels

SP 500

Overview:

Today Last Price: 2734

Today Daily change: 11.25 points

Today Daily change %: 0.41%

Today Daily Open: 2722.75

Trends:

Daily SMA20: 2655.89

Daily SMA50: 2609.8

Daily SMA100: 2689.94

Daily SMA200: 2750.83

Levels:

Previous Daily High: 2726.25

Previous Daily Low: 2698.75

Previous Weekly High: 2717

Previous Weekly Low: 2623.75

Previous Monthly High: 2714

Previous Monthly Low: 2441

Daily Fibonacci 38.2%: 2715.74

Daily Fibonacci 61.8%: 2709.26

Daily Pivot Point S1: 2705.58

Daily Pivot Point S2: 2688.42

Daily Pivot Point S3: 2678.08

Daily Pivot Point R1: 2733.08

Daily Pivot Point R2: 2743.42

Daily Pivot Point R3: 2760.58