Back

12 Feb 2019

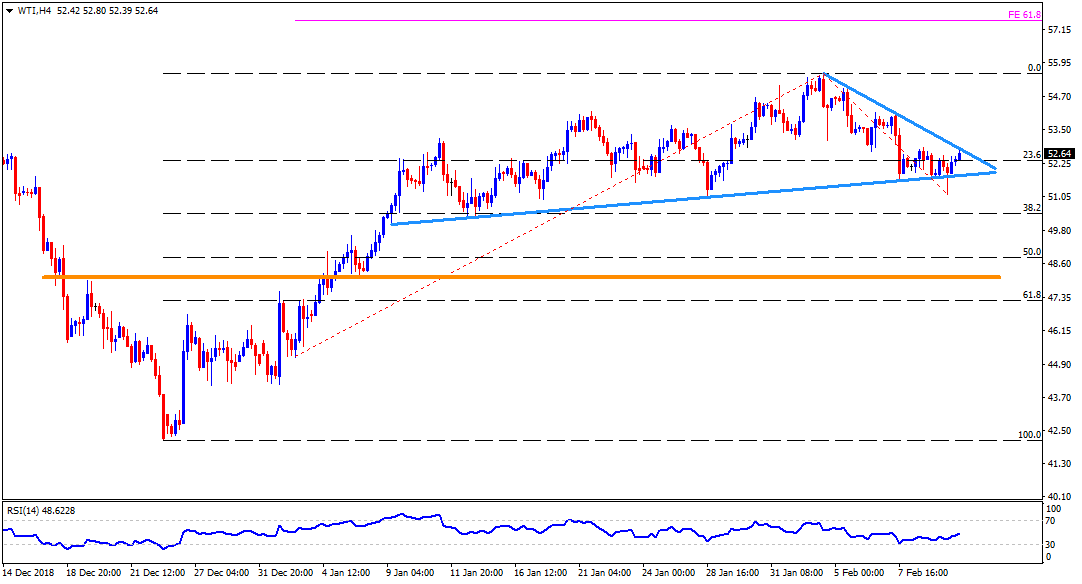

WTI Technical Analysis: $52.80 keeps challenging buyers

- WTI escalated prior gains to the intraday high of $52.80 before European markets open on Tuesday.

- The energy benchmark struggles around a weeklong downward sloping trend-line, at $52.80, in order to justify its strength.

- Should prices successfully clear $52.80 resistance-line, $54.20 and $54.90 may offer intermediate halts during rise to the current month high of $55.55.

- During the quote’s extended rally beyond $55.55, 61.8% Fibonacci Retracement of its latest up-moves, at $57.50, could flash on buyers’ radar.

- If at all the aforementioned trend-line continues to limit the upside attempts, an upward sloping support-line, at $51.80, may regain sellers’ attention.

- Moreover, quote’s declines past $51.80 might not hesitate to visit $51.00 and the $50.30 ahead of diverting markets to $50.00 round figure.

WTI 4-Hour chart

Additional important levels:

Overview:

Today Last Price: 53.1

Today Daily change: 35 pips

Today Daily change %: 0.66%

Today Daily Open: 52.75

Trends:

Daily SMA20: 53.47

Daily SMA50: 51.03

Daily SMA100: 56.65

Daily SMA200: 63.08

Levels:

Previous Daily High: 53.07

Previous Daily Low: 51.56

Previous Weekly High: 55.93

Previous Weekly Low: 52.05

Previous Monthly High: 55.48

Previous Monthly Low: 44.52

Daily Fibonacci 38.2%: 52.14

Daily Fibonacci 61.8%: 52.49

Daily Pivot Point S1: 51.85

Daily Pivot Point S2: 50.95

Daily Pivot Point S3: 50.34

Daily Pivot Point R1: 53.36

Daily Pivot Point R2: 53.97

Daily Pivot Point R3: 54.87