GBP/USD recedes from tops near 1.2940 post data

- Cable loses some traction after UK jobs data.

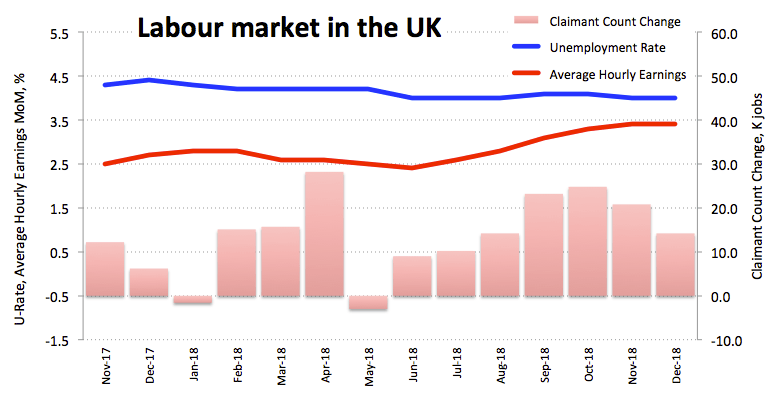

- UK jobless rate stayed unchanged at 4.0%.

- Claimant Count Change surprised to the downside.

The Sterling is alternating gains with losses vs. the greenback on Tuesday and is now prompting GBP/USD to retreat from earlier tops in the vicinity of 1.2940.

GBP/USD offered on poor data

The British Pound came under some selling pressure around 1.2940 after the monthly report on the UK labour market came in below expectations in December/January.

In fact, the Claimant Count Change came in at 14.2K in January vs. 12.3K forecasted and December’s 20.8K. In the same line, the key Average Earnings Index +Bonus expanded 3.4% YoY in December. Further data saw the jobless rate at 4.0%, matching consensus.

In the meantime, spot is now struggling for direction after a positive start of the week, with gains clearly limited by the 1.2940 region so far.

What to look for around GBP

The Sterling is expected to remain under increasing pressure as the clock continues to tick and there is no progress on the horizon (or even any hint of it) in the UK-EU divorce negotiations. So far, consensus among market participants points to a most likely extension of Article 50 in the next weeks or a deal on the 11th hour. However, the Irish backstop issue stays unsolved and a ‘hard’ scenario remains on the table ahead of the crucial vote on February 27. This, in combination with soft inflation figures as of late and prospects of extra deterioration in UK fundamentals should be enough to keep occasional rallies in GBP well capped.

GBP/USD levels to consider

As of writing, the pair is losing 0.02% at 1.2914 and a breach of 1.2877 (100-day SMA) would pave the way for a visit to 1.2818 (55-day SMA) and finally 1.2772 (low Feb.14). On the upside, the next hurdle aligns at 1.2958 (high Feb.13) followed by 1.2986 (21-day SMA) and then 1.3000 (high Jan.17).