Back

20 Feb 2019

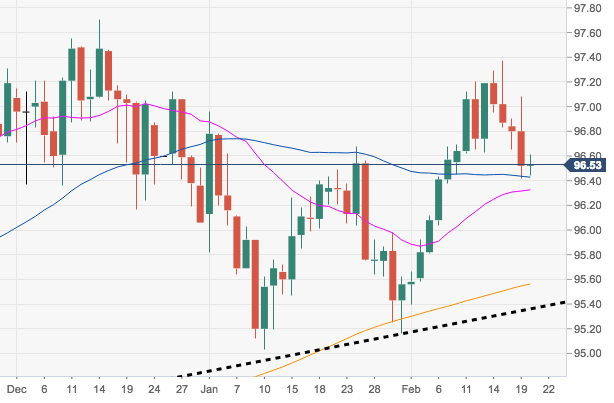

US Dollar Index Technical Analysis: The leg lower meets support in the 55-/100-day SMA near 96.40

- The index is prolonging the leg lower from last week’s YTD peaks, finding quite moderate support in the 96.40 region, where converge the 55- and the 100-day SMA.

- Further retracements are expected to face the Fibo retracement of the September-December up move at 96.22.

- In the broader picture, the constructive outlook in the buck remains unchanged while above the 200-day SMA at 95.56 and the short-term support line, today at 95.36.

DXY daily chart

Dollar Index Spot

Overview:

Today Last Price: 96.53

Today Daily change: 17 pips

Today Daily change %: 0.01%

Today Daily Open: 96.52

Trends:

Daily SMA20: 96.32

Daily SMA50: 96.39

Daily SMA100: 96.4

Daily SMA200: 95.55

Levels:

Previous Daily High: 97.08

Previous Daily Low: 96.42

Previous Weekly High: 97.37

Previous Weekly Low: 96.62

Previous Monthly High: 96.96

Previous Monthly Low: 95.03

Daily Fibonacci 38.2%: 96.67

Daily Fibonacci 61.8%: 96.83

Daily Pivot Point S1: 96.27

Daily Pivot Point S2: 96.01

Daily Pivot Point S3: 95.61

Daily Pivot Point R1: 96.93

Daily Pivot Point R2: 97.33

Daily Pivot Point R3: 97.59