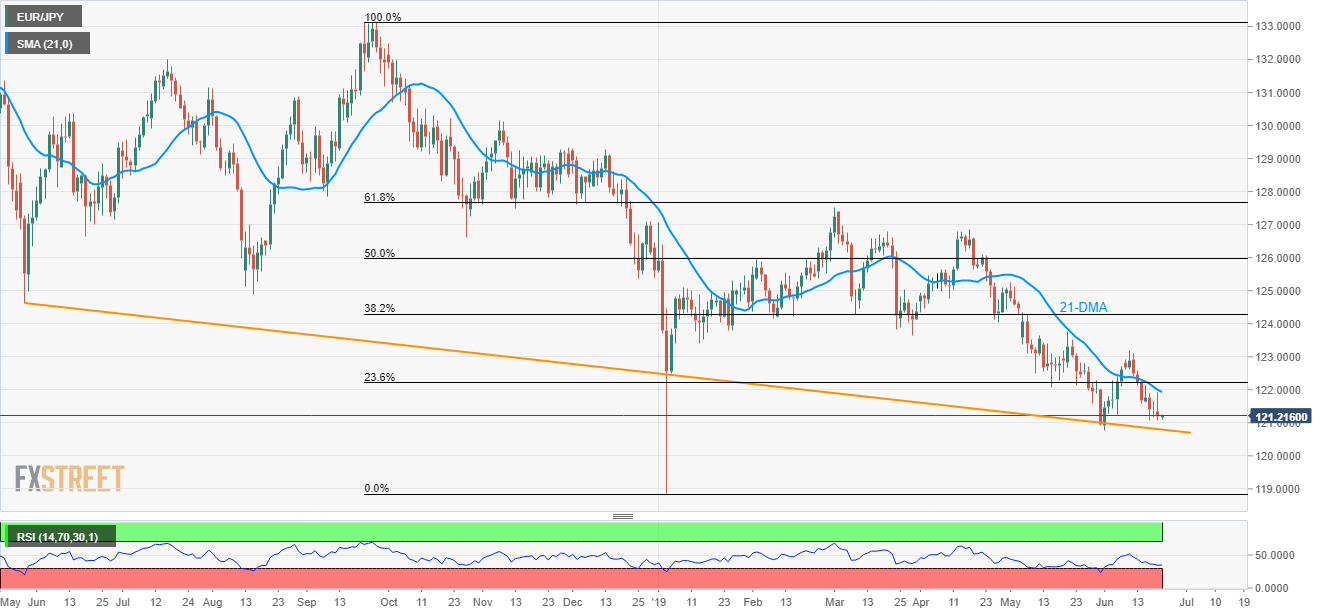

EUR/JPY technical analysis: 120.80/78 holds the gate for further selling towards January low

- The 13-month old trend-line support, latest low can question the EUR/JPY’s latest downpour.

- Bears’ sustained dominance can recall the current year bottoms.

Failure to cross 21-day moving average (21-DMA) continues to drag the EUR/JPY pair towards important support-zone as it trades near 121.15 on early Friday.

Oversold levels of 14-day relative strength index (RSI) highlights the strength of 120.80/78 support-zone comprising low and more than a year-long support-line (if ignoring January’s flash crash low).

In a case, prices slip under 120.78 on a daily closing basis, January month low near 118.85 could become next reference for the sellers while likely taking a halt near 120.00 round-figure in between the slump.

Alternatively, pair’s rise above 21-DMA level of 121.93 can trigger fresh up-moves to 23.6% Fibonacci retracement of September 2018 to January 2019 decline, at 122.21.

Also, successful trading above 122.21 enables the quote to question present month high around 123.81.

EUR/JPY daily chart

Trend: Pullback expected