Breaking: GBP/USD crashes below 1.2300 as Boris Johnson turbo-charges no-deal Brexit

The new British government led by PM Boris Johnson is "turbo-charging" its preparations for leaving the European Union without a deal. Johnson has set up three high-level ministerial committees to prepare for a cliff-edge Brexit. Moreover, senior minister Michael Gove – who leads one of these committees – has said that a hard exit is a "very real prospect." Foreign minister Dominic Raab has said that the EU must change and Brussels answered with anger.

The new PM's moves are now being taken seriously. Markets have initially dismissed Johnson's appointments of hard-Brexiteers and statements as preparations for early elections. Now they are hitting the panic button – at least when it comes to Sterling.

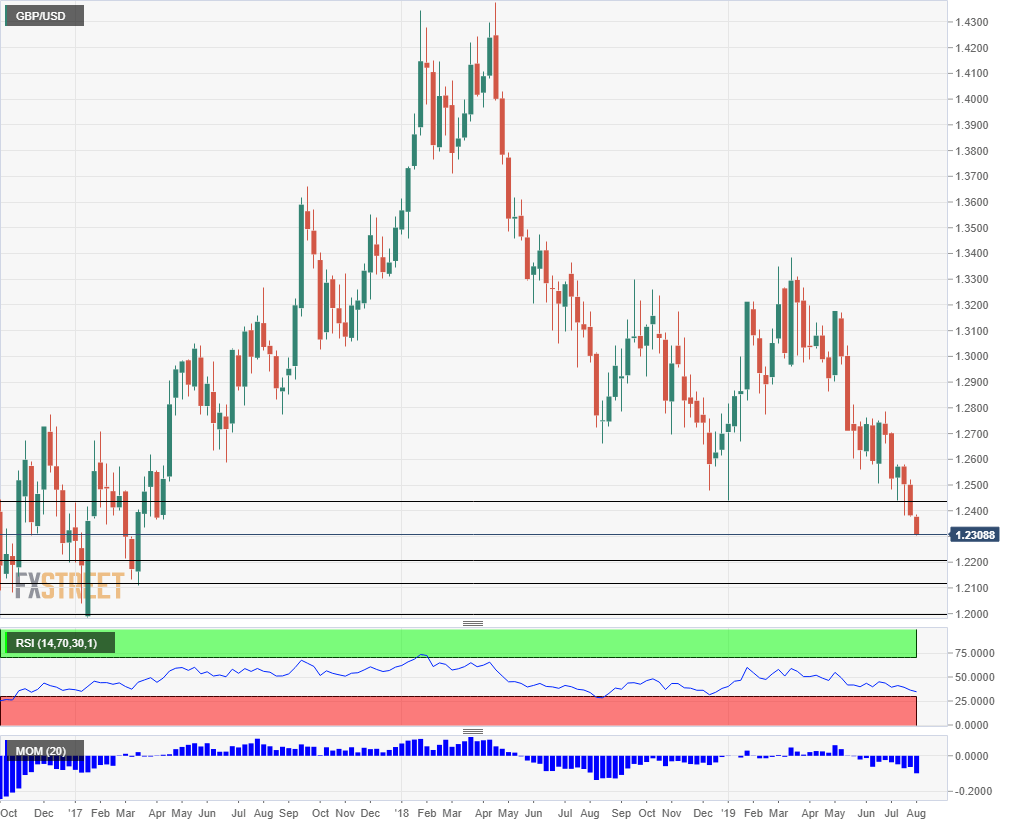

GBP/USD is trading below 1.2300 – at the lowest levels since March 2017. Support is seen at 1.2225, 1.2110, and 1.2000 – all levels that were last seen in 2017. The previous 2019 low of 1.2380 is the initial line of resistance, followed by 1.2440.

-- more to come