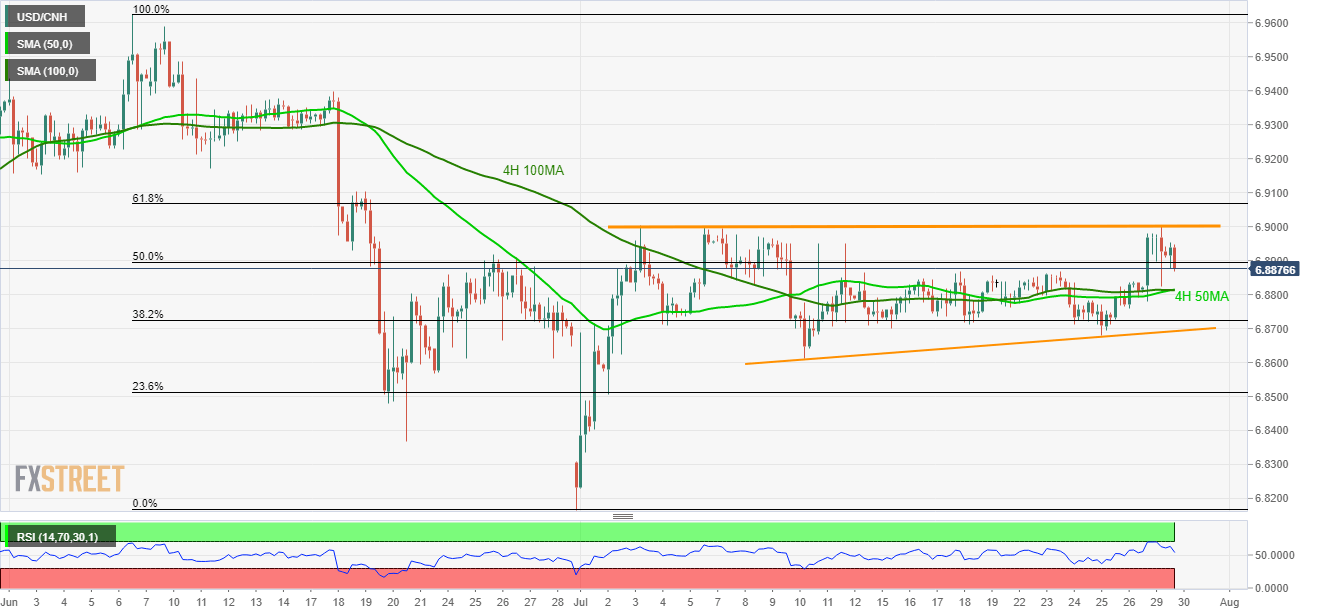

USD/CNH technical analysis: U-turn from 6.9000/05 highlights 4H 50/100 MA confluence

- USD/CNH keeps failing to cross the horizontal resistance region since early-month.

- 4H 50/100 MA confluence becomes near-term key support.

With its another failure to cross 6.9000/05 horizontal-area, USD/CNH witnesses pullback as it declines to 6.8871 ahead of Tuesday’s European session.

The pair now aims for the 6.8812/15 confluence including 50 and 100-bar moving averages on the 4-hour chart (4H 50/100 MA), a break of which can fetch prices to 12-day long ascending trend-line, at 6.8692.

Should the quote refrains from respecting 6.8692 support, 23.6% Fibonacci retracement of its June month south-run, at 6.8512, can be on sellers’ mind.

Meanwhile, an upside clearance of 6.90005 comprising multiple highs since early-month can trigger pair’s fresh advances to June 19 high close to 6.9100 ahead of pushing buyers towards early-June lows surrounding 6.9150/60.

USD/CNH 4-hour chart

Trend: Pullback expected