Back

2 Sep 2019

EUR/JPY technical analysis: Pullback likely amid oversold RSI condition

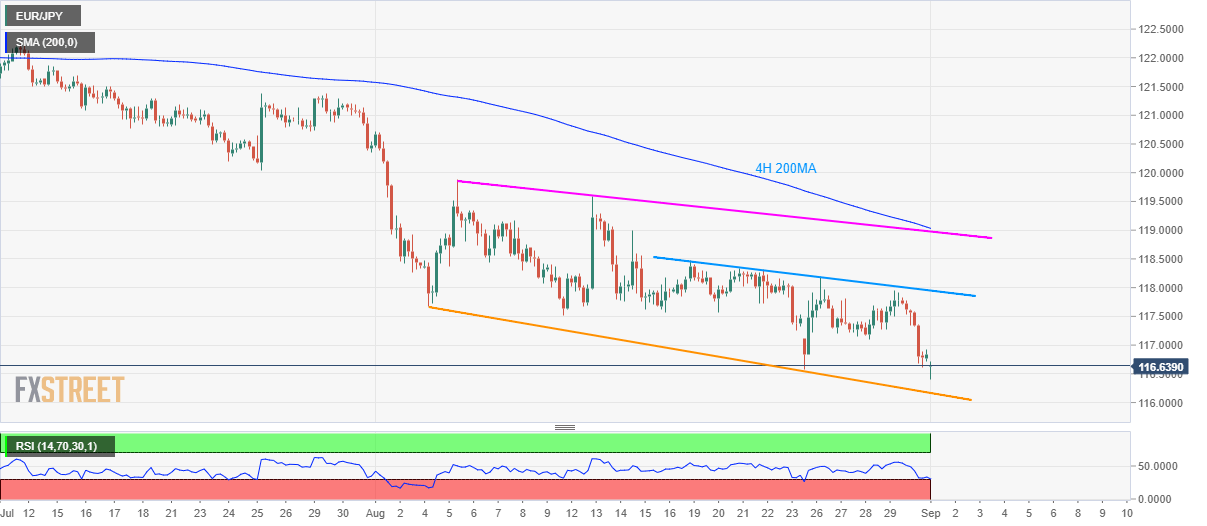

- EUR/JPY seesaws around multi-month low with 119.00/05 confluence being the key resistance.

- Oversold RSI conditions favor short-covering moves from near-term support-line.

EUR/JPY trades near April 2017 low while flashing 116.65 on the chart amid initial Asian morning on Monday.

Given the oversold conditions of 14-bar relative strength index (RSI), prices are likely to bounce off a four-week-old falling trend-line, at 116.17, failing to do so can drag it further down towards April 2017 low of 114.85.

On the contrary, 200-bar moving average on the four-hour chart (4H 200MA) and a downward sloping trend-line since August 06 limit the pair’s near-term upside around 119.00/05. Ahead of that, a two-week-old descending resistance-line at 118.00 could question pair’s quick rise.

In a case prices rally beyond 119.05, July 25 low surrounding 120.00 round-figure will flash on the buyers’ radar.

EUR/JPY 4-hour chart

Trend: pullback expected