Back

2 Sep 2019

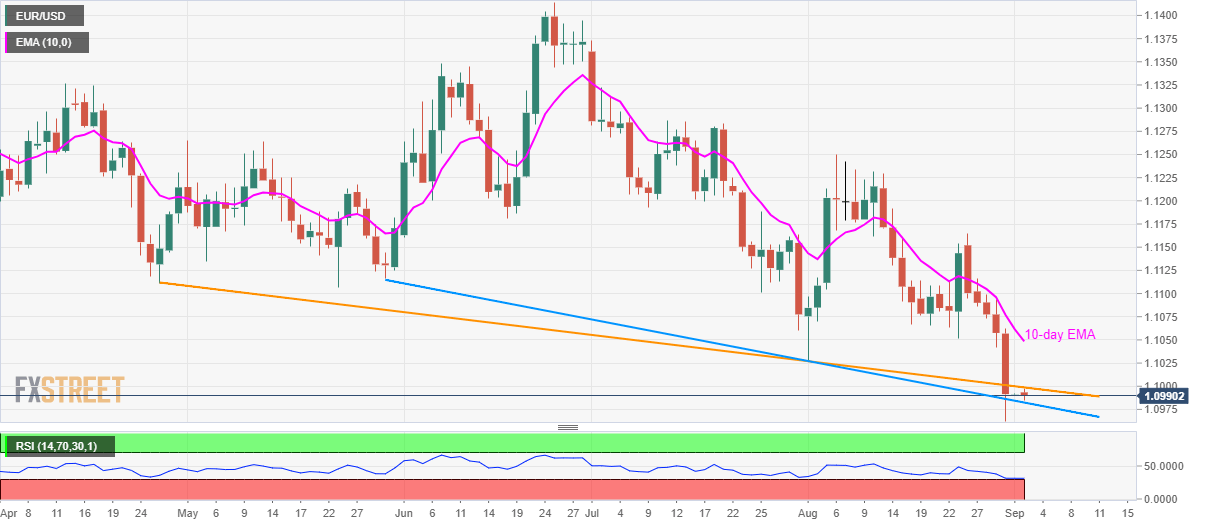

EUR/USD technical analysis: Choppy inside key trend-lines

- EUR/USD fails to extend downpour below 1.1000 mark.

- Three-month-old support limits the downside while a falling trend-line since April-end restricts immediate advances.

- RSI conditions are oversold.

EUR/USD struggles to extend declines below 1.1000 mark as it trades near 1.0990 during Monday’s Asian session.

The pair seesaws inside two downward sloping trend-lines respectively from late-April and May-end between 1.1000 and 1.0980 levels. However, oversold conditions of 14-day relative strength index (RSI) indicate brighter chances of the pair’s pullback.

In doing so, August 01 low near 1.1027 and 10-day exponential moving average (EMA) level of 1.1048 will gain short-term buyers’ attention whereas 1.1065 and 1.1100 could entertain them afterward.

Alternatively, a downside break of 1.0980 can take a halt at the recent low near 1.0960 ahead of questioning a year-old descending trend-line around 1.0920.

EUR/USD daily chart

Trend: pullback expected