USD/CNH technical analysis: Ignores weaker than expected China PMI, 7.03 back in focus

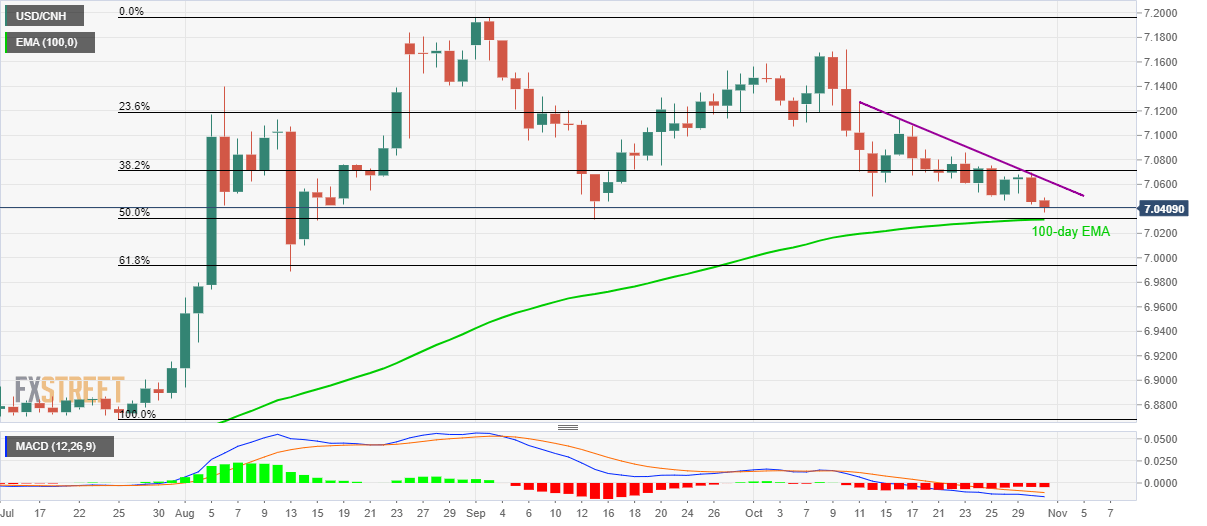

- USD/CNH remains under pressure below the nearly three-week-old falling trend line.

- China’s official activity numbers slipped beneath market forecasts in October.

- 100-day EMA, 50% Fibonacci retracement and lows marked since mid-August lure sellers.

With the near-term descending resistance line weighing over China’s downbeat PMI, USD/CNH trades close to the lowest since mid-September while taking rounds to 7.0430 during early Thursday.

China’s Purchasing Managers Index (PMI) numbers for October couldn’t bode well as the Manufacturing PMI declined below 49.8 forecast to 49.3 while Non-Manufacturing PMI weakened below 53.9 market expectations to 52.8.

Given the extended bearish signals from the 12-bar Moving Average Convergence and Divergence (MACD) indicator, prices are likely inching closer to a confluence of 100-day Exponential Moving Average (EMA), 50% Fibonacci retracement of late-July to early-September run-up and multiple lows marked since mid-August, around 7.0300.

Should bears refrain from respecting 7.0300 strong support, 61.8% Fibonacci retracement near 7.000 mark will be the key to follow.

Alternatively, an upside clearance of immediate declining resistance, at 7.0640, can trigger pair’s recovery to last week’s high around 7.0860 whereas 7.1130, 7.1280 and monthly top around 7.17 will please buyers afterward.

USD/CNH daily chart

Trend: bearish