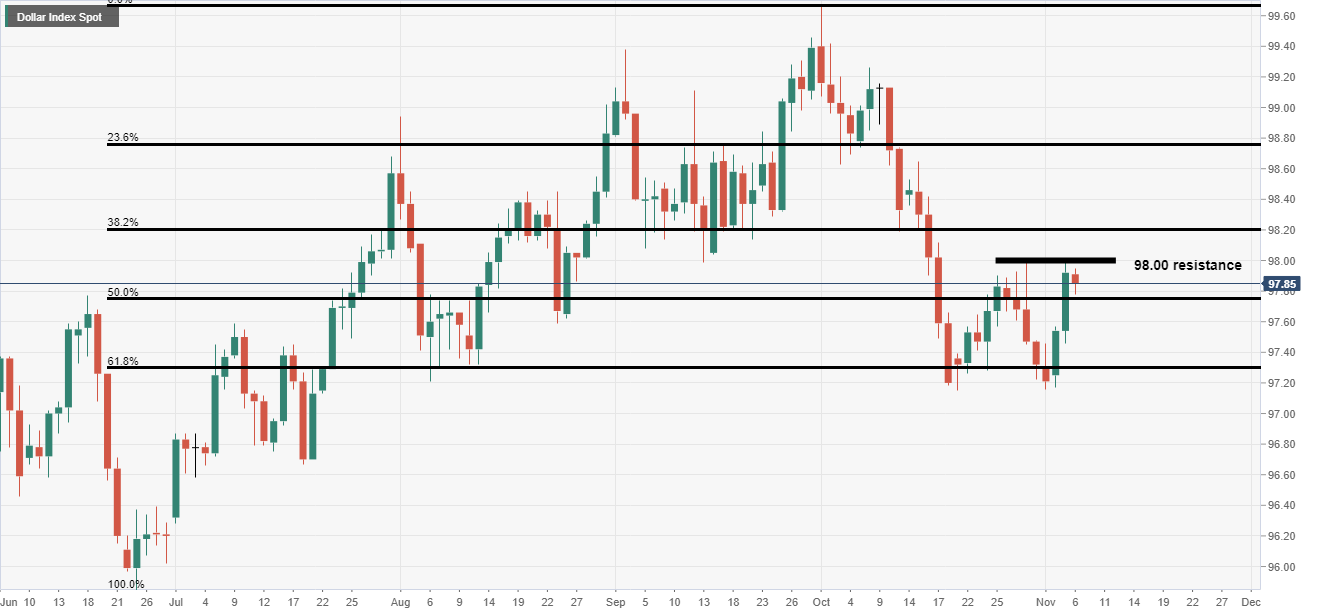

DXY pushes higher off the 61.8% Fib level on the daily chart

- The dollar index had a good session on Tuesday but is giving up some gains today.

- 98.00 seems to be the resistance level to beat now on the daily chart.

The dollar index responded well to the data yesterday as ISM non-manufacturing beat expectations.

This provoked a surge into risk assets away from safe havens like bonds, gold, JPY and CHF.

60% of the dollar index is made up of EUR/USD. On Tuesday this pair also performed well with EUR/USD falling 0.47%.

Looking ahead to today we are expected to hear from Fed's Williams and Harker. They are expected to tow the Fed's current line noting that the Fed is in a "good place" and waiting for more clues before acting in the future.

The Fed recently cut interest rates but cited the trade war between the US and China as one of the main reasons. The tone between the two economic powerhouses has now softened somewhat and this could mean the Fed may back off for a while. Also the labour market is performing well as the lastest NFP figure revealed.