NZD/USD Technical Analysis: Bulls target immediate resistance trendline after China data

- NZD/USD stops the previous day’s declines after China’s upbeat inflation data.

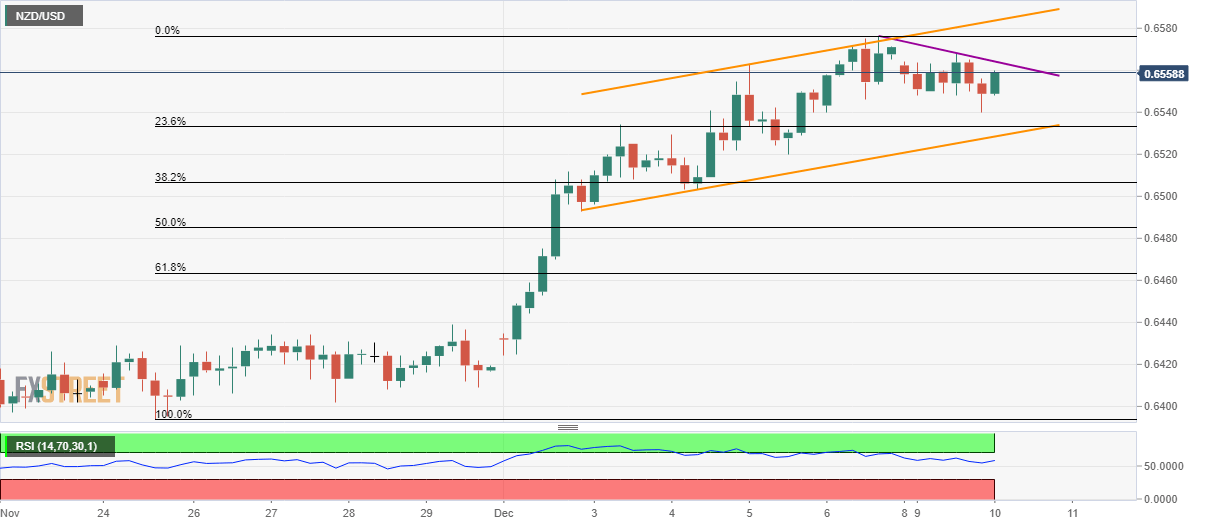

- An upside clearance of the adjacent resistance line can refresh a four-month high.

- Sellers await a downside break of the one-week-old rising channel.

NZD/USD takes the bids to 0.6560 after China released November month inflation data on early Tuesday.

Not only headlines Consumer Price Index (CPI) but the Producer Price Index (PPI) also beat market consensus while flashing 4.5% and -1.4% respective figures on a yearly basis.

Read: China CPI a touch hotter than expected 4.5% vs 4.2% exp YoY

With this, the kiwi pair aims to challenge the immediate falling resistance line, at 0.6565, in order to register a fresh high beyond August month’s top, flashed recently, around 0.6590. In doing so, 0.6600 and late-July top close to 0.6640 will be in the focus.

Alternatively, pair’s declines below a two-week-old rising trend channel's support, near 0.6528, can trigger fresh selling towards 0.6490 and 61.8% Fibonacci retracement of November 25 to December 06 upside, at 0.6463.

NZD/USD four-hour chart

Trend: Bullish