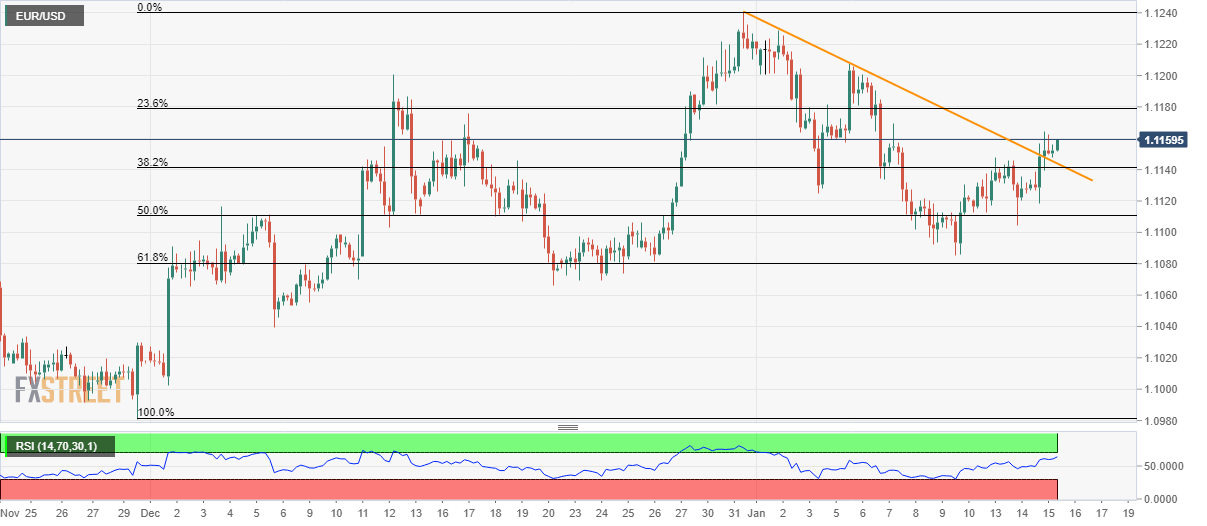

EUR/USD Price Analysis: Positive beyond 12-day-old resistance trendline

- EUR/USD nears the highest in a week.

- Buyers cheer a sustained break of short-term resistance to aim for 23.6% Fibonacci retracement.

- 61.8% of Fibonacci retracement becomes strong support.

EUR/USD rises to 1.1160 while carrying the break of short-term descending trend line since December 31 during Thursday’s Asian session.

With this, EUR/USD prices are near weekly high and progressing towards 23.6% Fibonacci retracement of the pairs’ rise from November 29 to December 31, at 1.1180 now.

Given the pair’s sustained break of short-term key resistance (now support), the quote may remain strong beyond 1.1180. In doing so, January 08 top surrounding 1.1210 could return to the charts ahead of pushing the Bulls towards the year-end peak of 1.1240.

On the downside, pair’s declines below 1.1140 resistance-turned-support can recall a 50% Fibonacci retracement level of 1.1110.

However, buyers will not accept the defeat unless the prices remain weak below 61.8% Fibonacci retracement level of 1.1080.

EUR/USD four-hour chart

Trend: Bullish