Back

3 Feb 2020

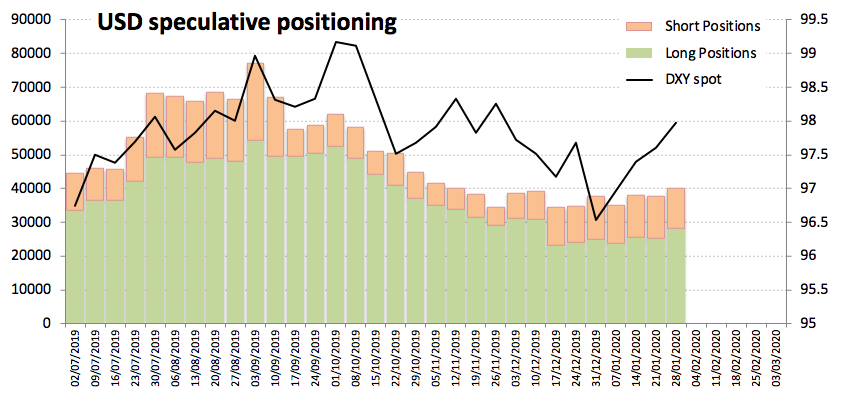

CFTC Positioning Report: USD net longs climbed to multi-week highs

These are the main highlights of the CFTC Positioning Report for the week ended on January 28th:

- Speculators added longs to the already positive positions in the dollar, taking the net longs to the highest level since December 17th. Traders appear to have positioned for a hawkish message from the Federal Reserve at its last meeting (following the cut-off date), particularly after positive results in the US docket.

- Crude oil net longs retreated to the lowest level since early December 2019. Oversupply concerns and demand fears stemming from the Chinese coronavirus continued to take a toll on traders’ sentiment for yet another week.

- Net shorts in the VIX (aka “the panic index”) receded to levels last seen in mid-September 2019, as concerns over the Wuhan coronavirus kept weighing on prospects of global growth.

- Gross longs in the sterling dropped for the third consecutive week, taking net longs to 3-week lows around 17.7K contracts. The likeliness of an interest rate cut by the BoE seems to have prompted some cautiousness among investors.