USD/MXN Price Analysis: Mexican Peso refreshes the record low near 25.00

- USD/MXN remains on the front foot, prints record top.

- Banxico announced emergency rate cut, US Senate fails to pass COVID-19 Bill.

- Risk-tone remains heavy, US stock futures tested “limit down” and bond yields decline.

In addition to the emergency rate cut from the Banxico, WTI weakness and the broad US dollar strength also contributed to the USD/MXN pair’s run-up to a fresh record high of 24.88 during Monday’s Asian session.

The Mexican central bank (Banxico) surprised marked with an emergency rate cut of 50 basis points (bps) to 6.50% on Friday. The central bank also said, “Global and domestic financial markets have been subject to high volatility over the last weeks due to the uncertainty regarding the impact of COVID-19 on world economic activity and to the recent fall in international oil prices. In this context, foreign exchange and fixed income markets in Mexico have undergone significant adjustments, lower liquidity, and deterioration of trading conditions.”

In addition to the rate cut, the early-week risk-off also contributed to the pair’s north-run. The market’s trade sentiment turned heavy during the early Asian session after the US Senate failed to pass on the COVID-19 Bill. Earlier, US President Donald Trump said to sign the trillion-dollar bill today.

Also contributing to the risk-off were increasing coronavirus (COVID-19) numbers and a slew of policy measures as well as the signals to the risk of the US recession.

While portraying the risk-tone, the US stock futures initially slumped to the “limit down” level, currently around 4.0% minutes, whereas the US 10-year treasury yields also extend losses to 0.837% by the press time.

Further, oil prices, the main catalyst for the Mexican peso, bear the burden of demand forecast amid virus spread as well as global producers’ disagreements over the output.

Markets will now take clues from the US Senate as well as global rush ward off the deadly disease. In doing so, the US dollar can keep the gains while commodities and the linked currencies might have to witness further weakness.

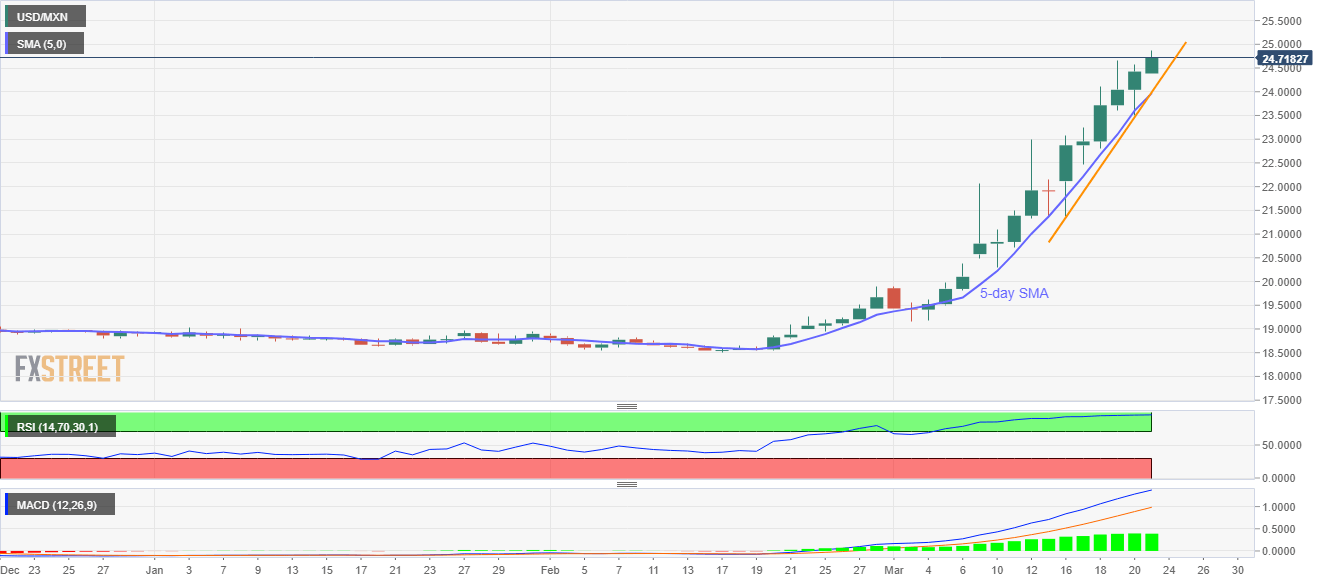

USD/MXN forecast chart

The 5-day SMA and a one-week-old rising trend line limit the pair’s short-term declines near 24.00.

Trend: Bullish