AUD/JPY Price Analysis: Multiple barriers on the road to recovery

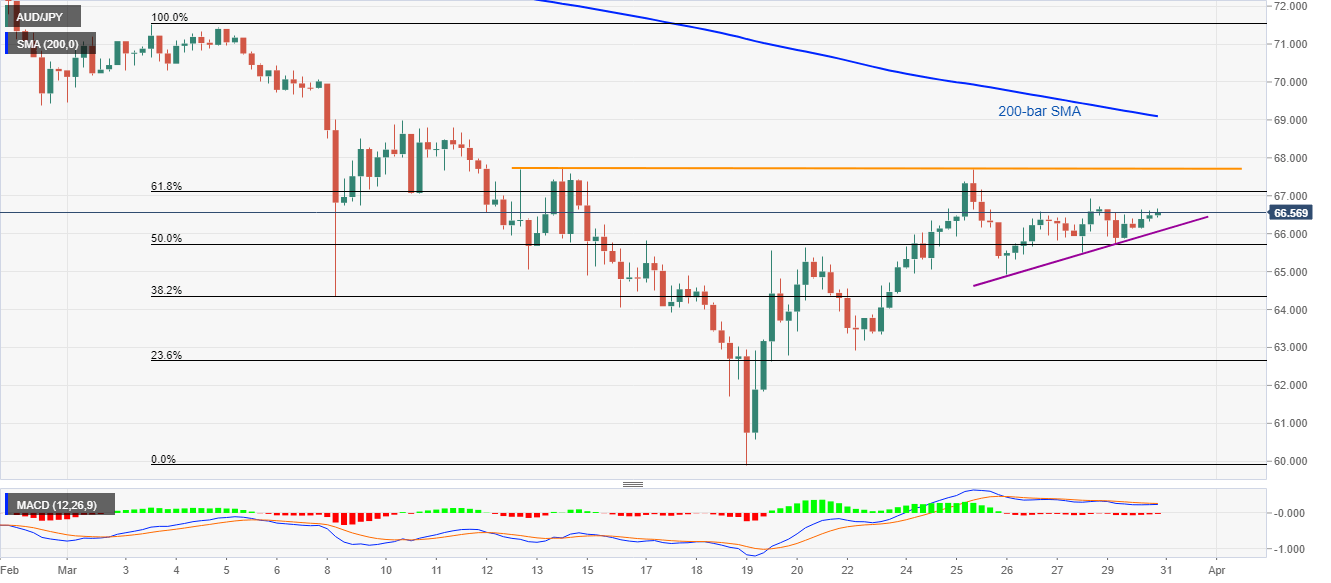

- AUD/JPY remains on the front-foot, follows the short-term rising trend line.

- 61.8% Fibonacci retracement, a 13-day-old horizontal resistance hold the key to 200-bar SMA.

- A lack of momentum signals the continuation of mild run-up.

AUD/JPY remains mildly positive around 66.55 amid the initial Asian session on Tuesday. In doing so, the pair continues to take clues from a three-day long rising trend line while heading towards 61.8% Fibonacci retracement of its early-month declines.

In addition to 67.10 immediate resistance, a horizontal trend line since March 12, 2020, around 67.70/75, also restrict buyers from challenging the 200-bar SMA level of 69.10.

If at all the bullish momentum gain strength past-69.10, 70.00 round-figure will be back on the charts.

Meanwhile, the pair’s break below the immediate support line near 66.00 can push it to 50% Fibonacci retracement level around 65.70 while the previous week’s low near 62.90 could gain the bears’ attention afterward.

AUD/JPY four-hour chart

Trend: Further recovery expected