GBP/NZD Price Analysis: Accumulating at critical weekly support ahead of monthly bullish trendline

- GBP/NZD bulls looking for weekly support to hold.

- Trendline support tests may need to wait at this juncture.

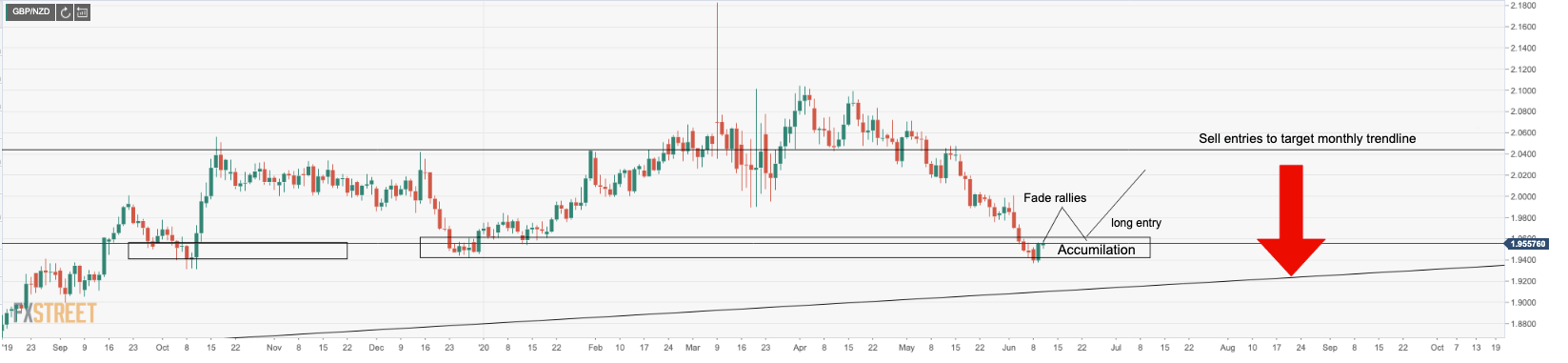

GBP/NZD is by no means showing a buying opportunity, yet, but the price has moved towards an area of accumulation and is worth having on the radar at this juncture.

The cross has been in a strong downtrend of late and the daily time frame clearly illustrates that the market is still very much bearish.

However, the current low is equal to the prior weekly low and a pause for thought here could lead to an accumulation strategy in the pair, fading rallies to only accumulate again at a later stage.

On the other hand, trendline support could be tested sooner and without a series of demand and supply. In such a case, bulls will look to accumulate and buy on dips on a long-term run higher.

The following series of charts is a top-down analysis of this cross which illustrates potential scenarios should the current weekly support indeed stem the daily bearish flow and hold:

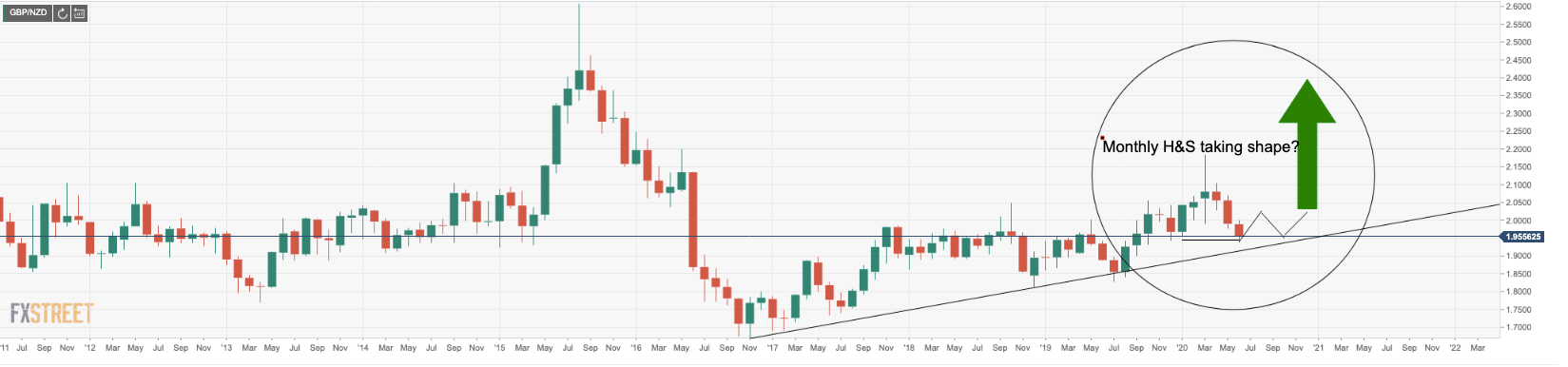

Bullish trendline

The above chart is a monthly chart that illustrates the bullish outlook according to tot he monthly trendline.

However, there is a detailed outlook to following in what could be the makings of a mid-range H&S pattern that will need to play out before the trendline will be tested again over the coming weeks.

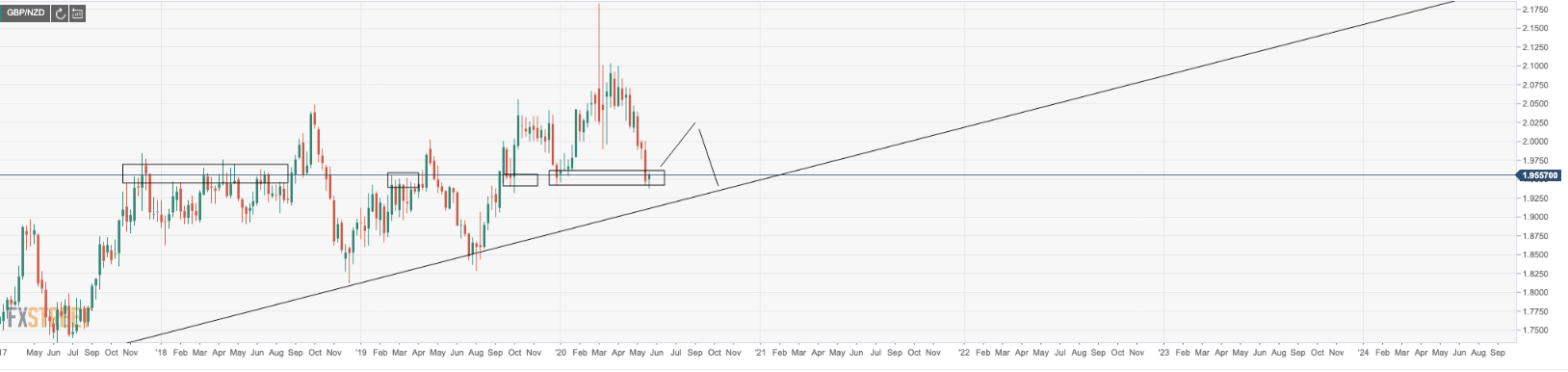

Weekly support structure

Accumulation

Accumulate to fade and accumulate to fade to trend line support

As illustrated, while the bear trend is firmly in place, there is now the possibility, however, that the price will move to the upside, in which case, the above scenario could be played out.