JP Morgan, Wells Fargo and Citi post earnings on Tuesday here is what to expect

- Will the big banks make provisions for losses incurred during the COVID-19 pandemic.

- Investors will be looking out for any comments from JP Morgans Jamie Dimon on the economy.

The backdrop on bank stocks

Banks are expected to put aside some funds for loans that may have defaulted during the COVID-19 pandemic. On the other end of the stick, there could be a boost from trading revenues as the market volatility could have provided some opportunities in the investment arms of the banks. Year to date JP Morgan's share price is down around 29%, while Wells Fargo lost around 50% and Citigroup lost 34%. Although this is unsurprising considering the circumstances, news on how they plan to navigate the future will be very important to investors. JP Morgan CEO Jamie Dimon's comments have a propensity to move the markets and this time out his opinion on the shape of the recovery could be very important. He normally strikes an optimistic tone but this time out comments on timings about a return to normal will be in focus. Recently the easing of some of the restrictions from Volcker rule has been bullish for banking stocks as it could release around USD 40bln for investments in the markets and there could also be some mention of this development.

JP Morgan

Importantly the estimated provision for loans is USD 8,105mln. Net income is expected at USD 3,438mln. Revenue is expected to come in at USD 30,407mln and EPS at USD 1.08 Q1 EPS was 0.78c.

The chart shows the share price is very close to the psychological 100.00 level. Interestingly, the price broke through the 55 Simple Moving Average and momentum seems to be with the bulls. The most recent wave low has been a higher low but the next wave high is some way off at 115.77. The next key resistance is at 104.39 and could be a pivotal zone if the bulls do remain in charge.

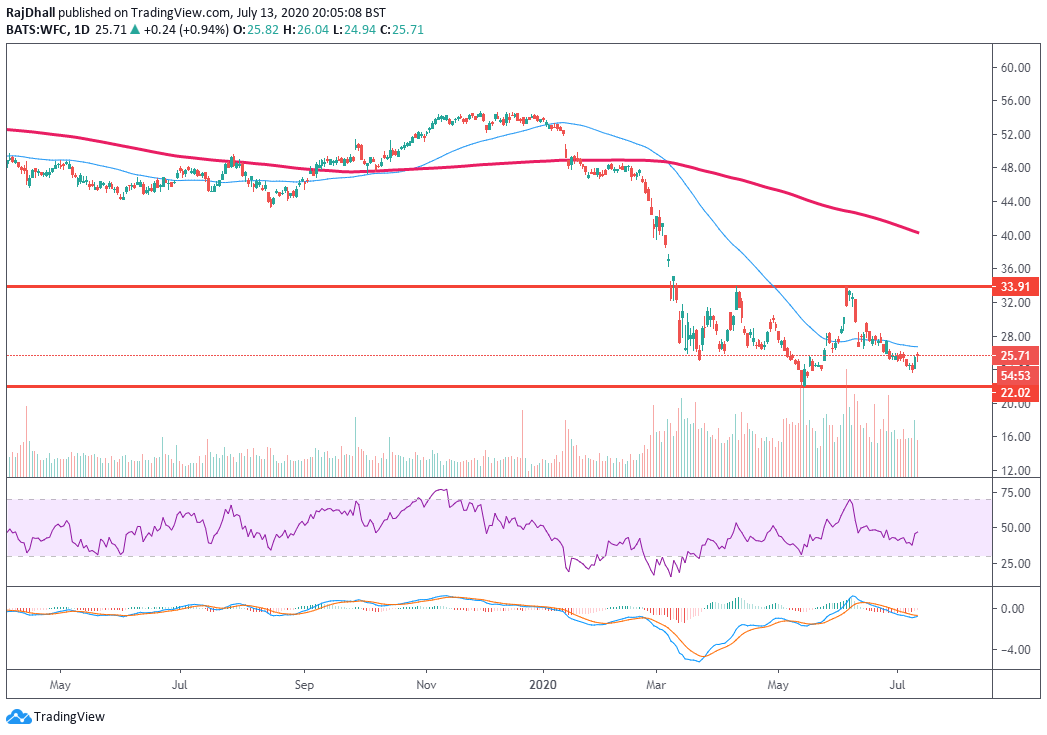

Wells Fargo

Wells Fargo's estimated EPS is USD -0.05 and they are estimated to have an earnings loss of USD 162mln. Revenue is forecast to come in at USD 18,400mln. The chart is not as bullish as the JP Morgan one above but that is reflected in their estimates. The price us under the 55 Simple Moving Average but is holding above the 25.00 level. There seems to be slightly more traffic ahead of a move higher but over the last two sessions, the price has increased.

Citigroup

The estimated forecast for EPS stands at USD 0.30 and the provision for bad loans stands at USD 6,953mln. The forecast net income figure is USD 773mln, while revenue is expected at USD 19,090mln. The Citigroup daily chart is more like JM Morgan's and seems more bullish. There is a clear higher low at the red support level and once again the 50-period Moving Average was used as a support level. Again the price is above the psychological 50 level but a break of the black downward sloping resistance will be important.