S&P 500 Futures: En route 3,300 amid lack of healthy resistance levels – Confluence Detector

At five-month highs, S&P 500 futures are gearing up for additional upside, with the 3,330 level now in sight. The US stock futures benefit from the coronavirus vaccine progress and EU stimulus deal. Technicals are also pointing towards extra gains.

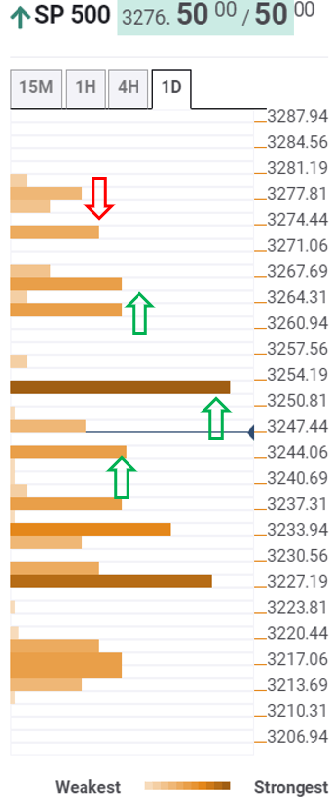

The Technical Confluences Indicator suggests that the upside appears more compelling for S&P 500 futures, as the bulls have managed to clear the major resistance levels en route the critical 3,300 mark.

However, minor hurdle at 3,278 could challenge the immediate upside. That level is the pivot point one-day R2.

To the downside, the cluster of supports is placed around 3,265, the convergence of pivot point one-week R1 and Bollinger four-hour Upper.

Further south, strong support is seen 3,254, the previous year high, which will challenge the bears’ commitment going forward.

A failure to defend the latter will trigger a fresh round of selling, with the next downside target aligned at 3,244. The previous week's high meets the previous low on 15-minutes at that support area.

S&P 500 Chart

Here is how it looks on the tool:

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

This tool assigns a certain amount of “weight” to each indicator, and this “weight” can influence adjacents price levels. These weightings mean that one price level without any indicator or moving average but under the influence of two “strongly weighted” levels accumulate more resistance than their neighbors. In these cases, the tool signals resistance in apparently empty areas.

Learn more about Technical Confluence