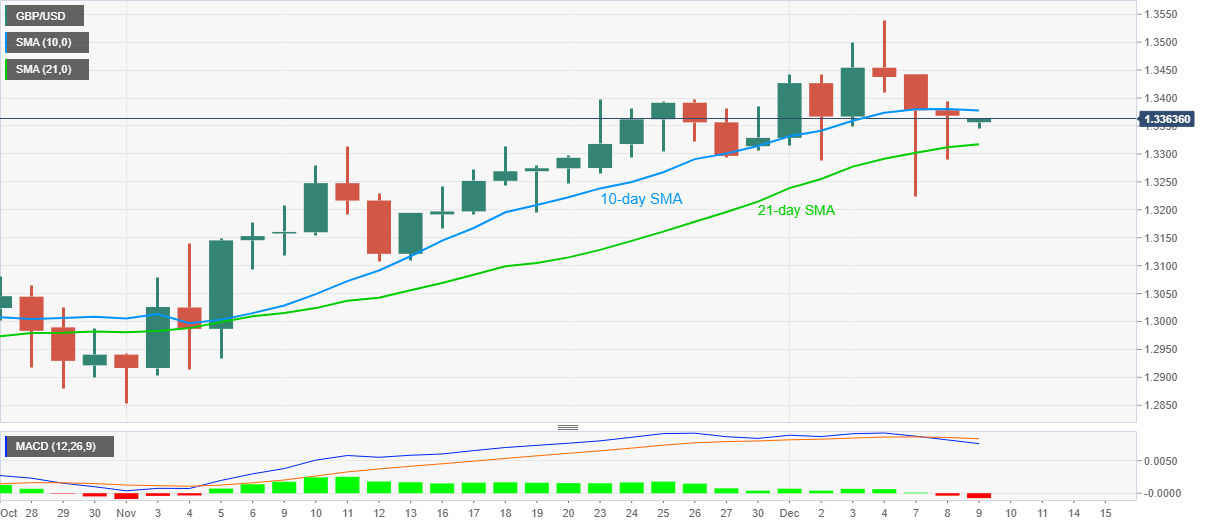

GBP/USD Price Analysis: 10-day SMA probes corrective pullback below 1.3400

- GBP/USD picks up bids after three-day downtrend fails to break 21-day SMA.

- Bearish MACD, Brexit woes keep sellers hopeful, bulls may eye for a clear break above 1.3500.

GBP/USD rises to 1.3370, currently around 1.3363, during the pre-Tokyo open Asian trading on Wednesday. In doing so, the Cable snaps a three-day losing streak while justifying repeated failures to decline below 21-day SMA. However, 10-day SMA guards the pair’s immediate upside amid bearish MACD signals.

Hence, GBP/USD buyers should look for entries beyond 1.3377 nearby SMA resistance while targeting the 1.3400 as an intraday aim.

Though, further upside past-1.3400 needs clear break above 1.3500 round-figure wherein September top around 1.3485 can offer an intermediate halt while the recent highs near 1.3540 may serve as the following target.

Meanwhile, a downside break below 21-day SMA level, at 1.3317 now, can recall November 13 low close to 1.3110.

In doing so, GBP/USD sellers will have to conquer the monthly bottom surrounding 1.3225/20.

GBP/USD daily chart

Trend: Pullback expected