AUD/USD Price Analysis: 0.7560 is a tough nut to crack for the bulls

- AUD/USD holds the lower ground near mid-0.7500s.

- The hourly chart points to a potential rebound.

- A bunch of healthy resistance levels is stacked up.

AUD/USD has paused its sell-off and looks set to extend the bounce in the session ahead, although a bunch of healthy barriers on the upside could make it a difficult ride for the AUD bulls.

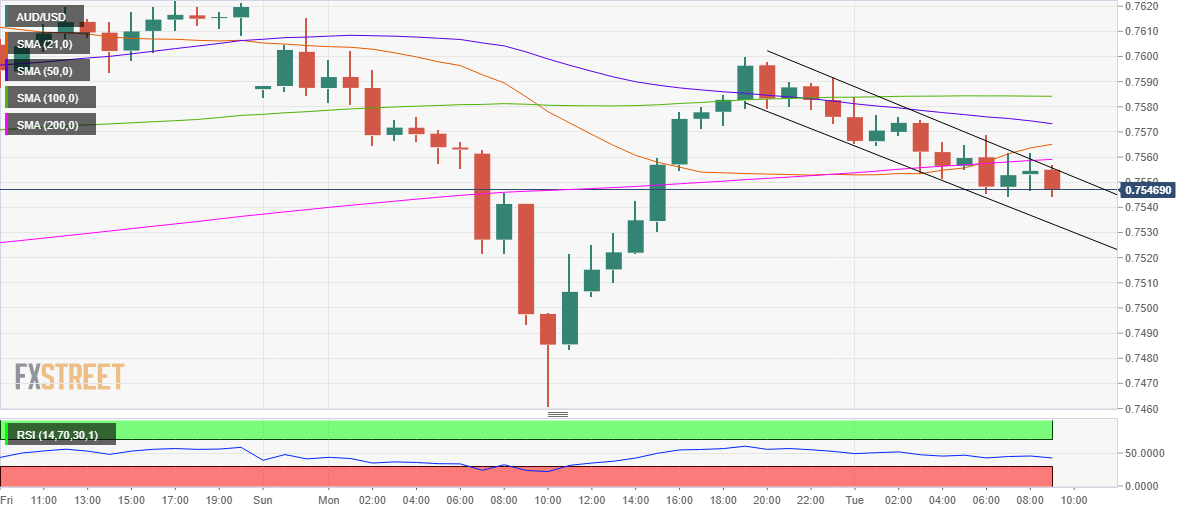

Technically, the pair wavers in a falling channel on the hourly chart.

A sustained move above the key hurdle at 0.7555-0.7559 is needed to extend the recovery momentum. That level is the confluence area of the 200-hourly moving average (HMA) and the falling trendline resistance.

Further north, the 21-HMA at 0.7565 will also limit the upside. Ahead of the 50-HMA barrier at 0.7573 could challenge the bulls’ commitment.

The hourly Relative Strength Index (RSI) points south while below the midline, suggesting that the recovery attempts are likely to be shallow.

The immediate cushion is seen at the falling trendline support at 0.7533. A breach of the last could trigger a sharp drop towards the 0.7500 level.

AUD/USD: Hourly chart

AUD/USD: Additional levels