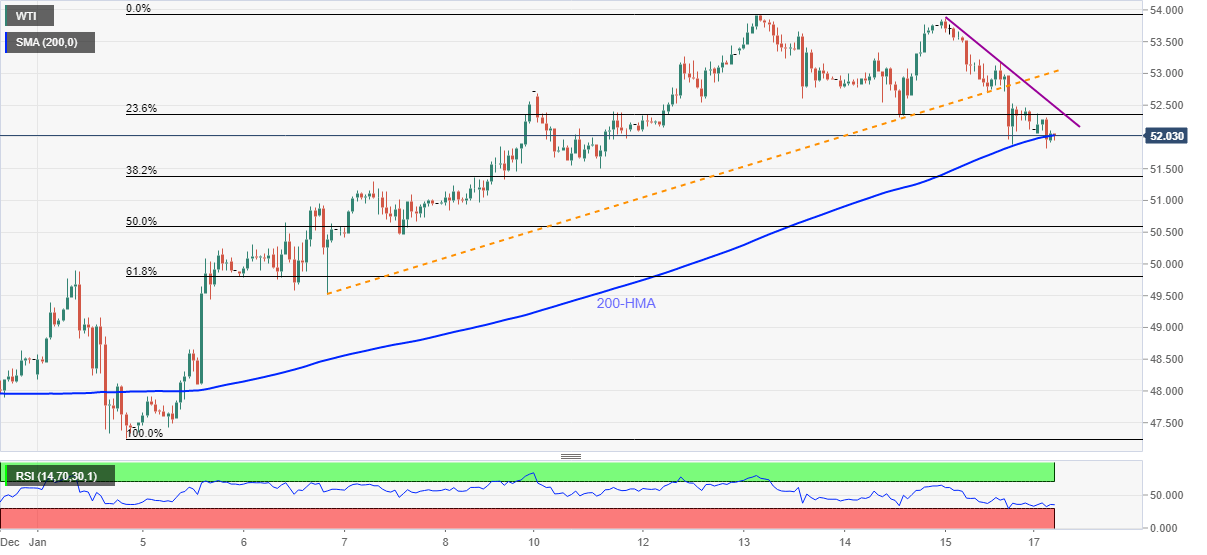

WTI Price Analysis: 200-HMA probes sellers around $52.00

- WTI remains on the back foot around one week low.

- RSI conditions favor corrective pullback towards short-term resistance line.

- Sellers may eye $51.30 as extra downside filter.

WTI wavers around $52.00, down 0.44% on a day, during early Monday. In doing so, the energy benchmark trades near the lowest level in one week as bears battle 200-HMA.

It should be noted that RSI conditions are also nearly oversold and can trigger the quote’s bounce. As a result, a downward sloping trend line from Friday, currently around $52.50, can lure intraday buyers.

However, any further upside will eye to refresh the multi-month high, marked earlier during the month, around $54.00.

During the rise, the black gold may avail an intermediate halt around $53.30 while February 2020 peak surrounding $54.70.

Alternatively, a sustained downside below 200-HMA level of $52.00 will eye for $51.00 and 61.8% Fibonacci retracement of January 04-13 upside, near $49.80.

Overall, WTI is in an uptrend but the intermediate pullbacks can’t be ruled out.

WTI hourly chart

Trend: Pullback expected