Gold Price Analysis: XAU/USD stays capped by the $1,880 area

- Prices of the yellow metal adds to Friday’s advance around $1,870.

- The rebound in prices comes despite the stronger mood in the dollar.

Prices of the ounce troy of the yellow metal advance for the third session in a row on Monday, although it seems to have met some resistance around $1,880, area coincident with the 100-day SMA.

The continuation of the uptrend in gold comes despite moderate gains in the greenback, which is pushing the US Dollar Index (DXY) to the proximity of YTD highs in the 91.00 region.

Also collaborating with the upbeat momentum in gold appears the rally in silver, which continues unabated its march north fuelled by the so-called “Reddit-mania”. In the same direction, steady yields of the US 10-year benchmark also lends wings to the precious metal.

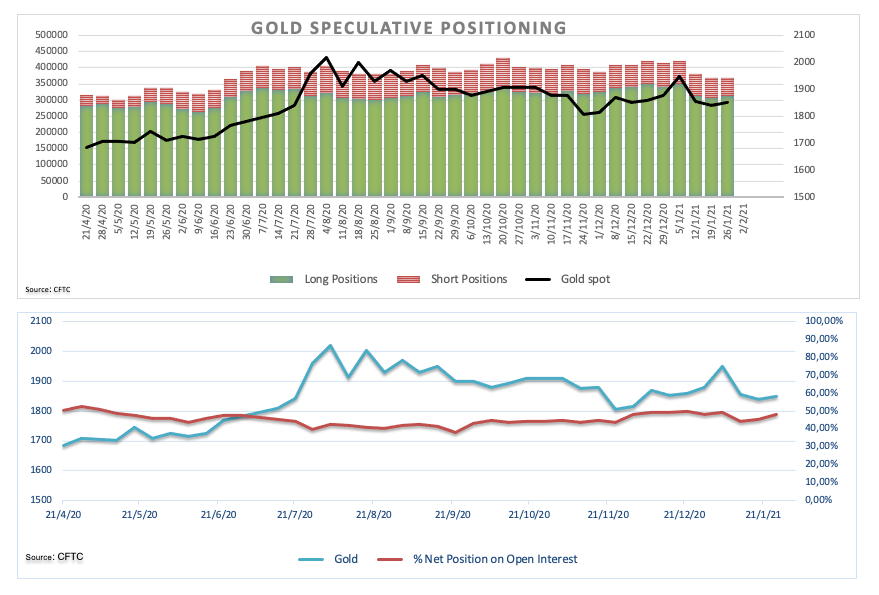

On another front, net longs in Gold climbed to 3-week highs during the week ended on January 26th according to the CFTC Positioning Report.

Gold key levels

As of writing Gold is gaining 0.96% at $1,864.66 and a surpass of $1,878.10 (100-day SMA) would expose $1,906.64 (monthly high Dec.21 2020) and finally $1,959,33 (2021 high Jan.6). On the downside, the next support is located at $1,831.52 (weekly low Jan.27) seconded by $1,802.47 (2021 low Jan.18) and then $1,764.73 (monthly low Nov.30 2020).