AUD/NZD Price Analysis: Bears eye 11-month-old support line on upbeat NZ Q4 jobs report

- AUD/NZD stays heavy near recently flashed two-month low.

- New Zealand Unemployment Rate, Employment Change offered positive surprises in Q4.

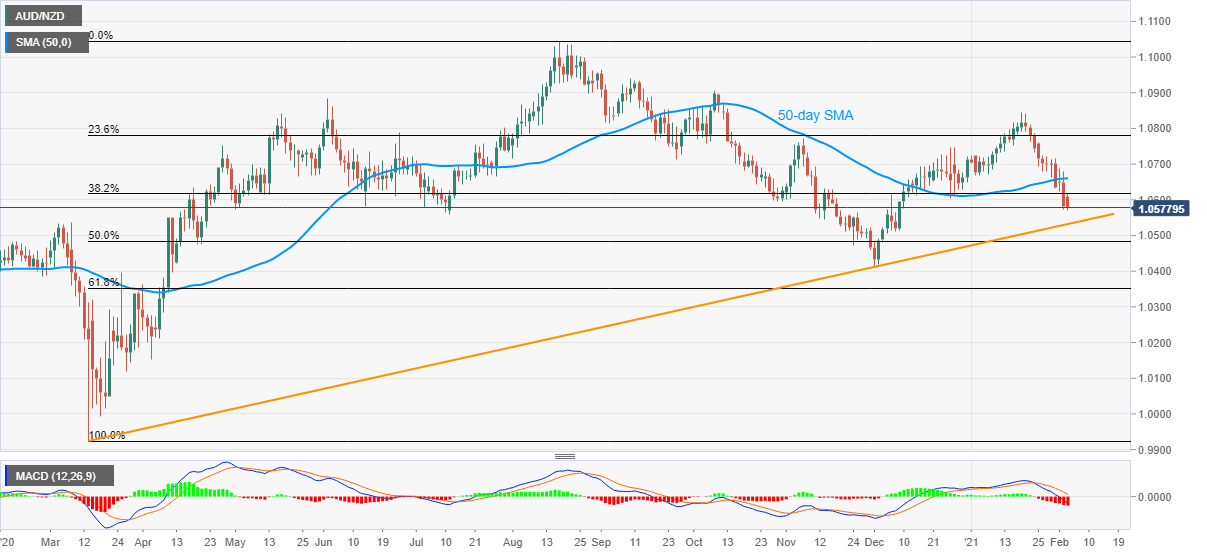

- Bearish MACD, sustained trading below 50-day SMA favor bears.

AUD/NZD takes offers near 1.0560 following its slump to the early December lows amid the initial Asian session trading on Wednesday. The quote declined heavily after New Zealand (NZ) jobs report for the fourth quarter (Q4) flashed strong data.

Read: New Zealand Q4 Unemployment Rate dropped below expectations of 5.6% to 4.9%, NZD/USD jumps 30 pips

The welcome figures help the AUD/NZD bears to direct the previous day’s downside break of 50-day SMA towards an ascending trend line from March 2020, currently around 1.0530, amid bearish MACD.

Should the AUD/NZD sellers refrain from respecting the strong support line, the 1.0500 threshold and 50% Fibonacci retracement level of March-August 2020 upside near 1.0480, followed by November 2020 bottom surrounding 1.0410, should gain the market’s attention.

Meanwhile, corrective pullback needs a daily closing beyond the 50-day SMA level of 1.0660 to regain the 1.0700 round-figure.

However, any further upside will be challenged by December 2020 tops near 1.0745 and the January 2021 peak surrounding 1.0845.

Overall, AUD/NZD is ready to test the key support but any further downside needs extra strong catalysts from New Zealand or downbeat factors from Australia.

AUD/NZD daily chart

Trend: Bearish