Back

12 Feb 2021

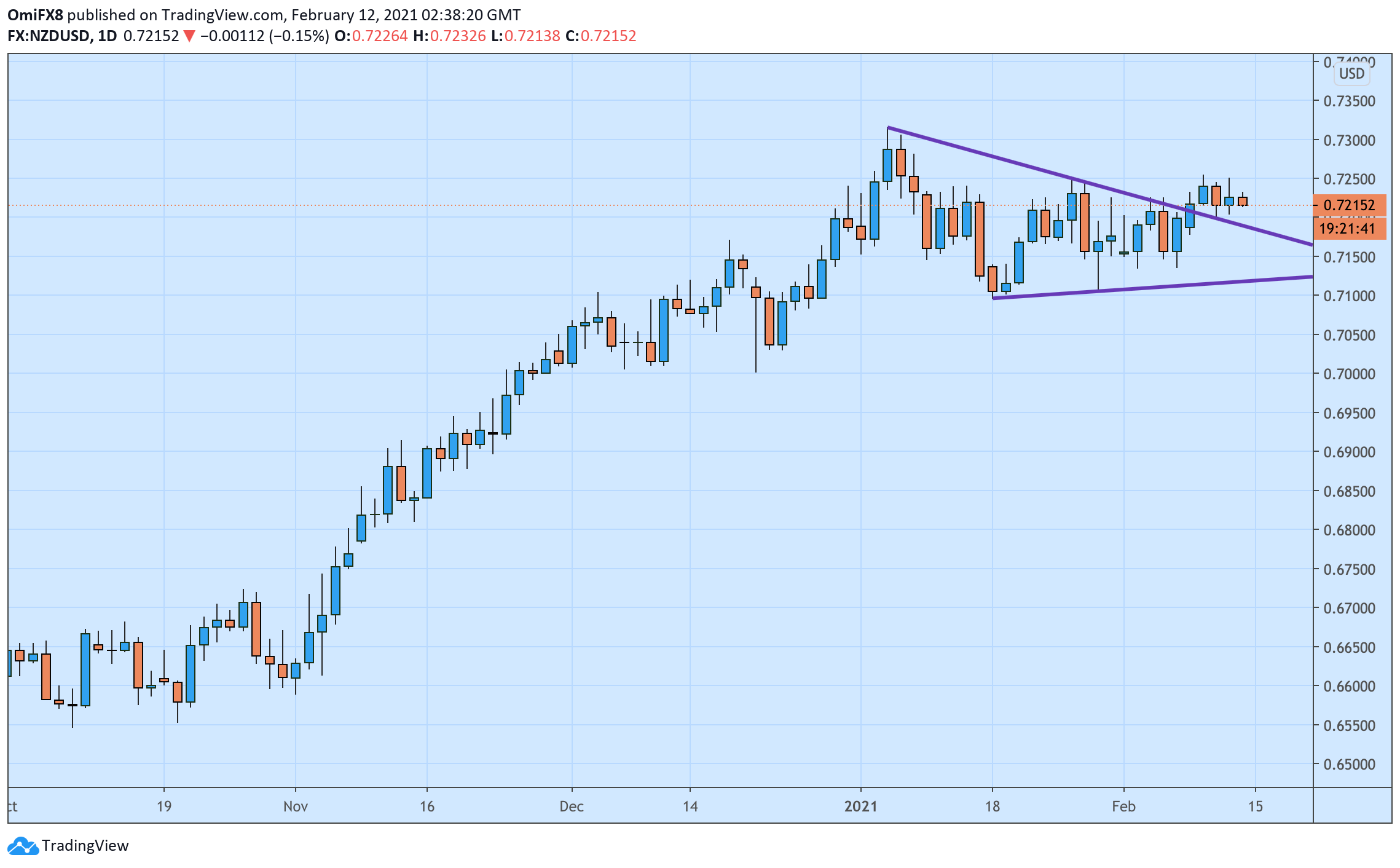

NZD/USD Price Analysis: Pullback from 0.7250 neutralizes immediate bullish bias

NZD/USD is currently trading near 0.7215, representing a 0.15% drop on the day.

The pair has failed multiple times to establish a foothold above 0.7250 earlier this week. That, alongside the latest drop to 0.7215, has neutralized the bullish view put forward by a triangle breakout confirmed on Feb. 8.

The pair now risks falling below 0.72 with the hourly chart MACD histogram and Relative Strength Index signaling bearish conditions.

A close above 0.7255 (Feb. 9 high) is needed to put the bulls back into the driver's seat. That would open the doors for a re-test of 0.7315 (Jan. 6 high).

Daily chart

Trend: Neutral

Technical levels