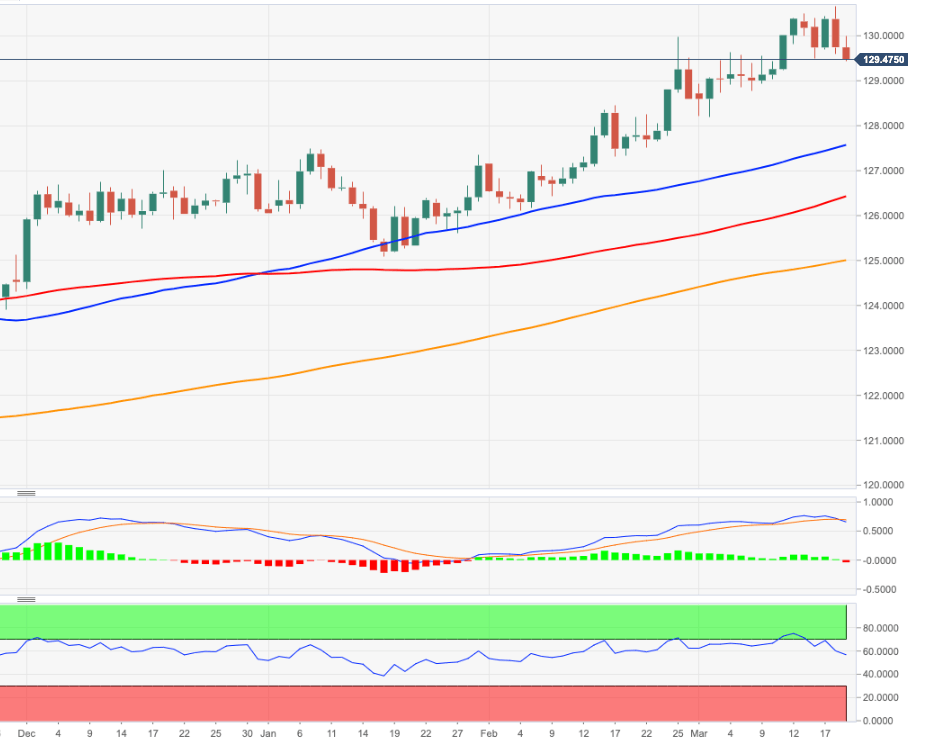

EUR/JPY Price Analysis: Interim support lines up at 129.20

- EUR/JPY extends the knee-jerk well below the 130.00 level.

- There is an interim support at the 20-day SMA around 129.20.

EUR/JPY breaks below the psychological 130.00 yardstick and navigates in multi-day lows in the mid-129.00s.

Despite the corrective downside, the positive bias in the cross remains well and sound for the time being. Against that, further upside still remains on the cards and the surpass of YTD highs near 130.70 should allow for extra gains with immediate target at the 131.00 hurdle followed by the summer 2018 high at 131.98 (July 17).

Reinforcing the current positive stance, EUR/JPY keeps trading above the immediate support line (off November 19 2020 low) in the 127.60 area, also coincident with the 50-day SMA. Below this area, the upside pressure is forecast to alleviate somewhat.

In the meantime, while above the 200-day SMA at 124.92 the broader outlook for the cross should remain constructive.

EUR/JPY daily chart