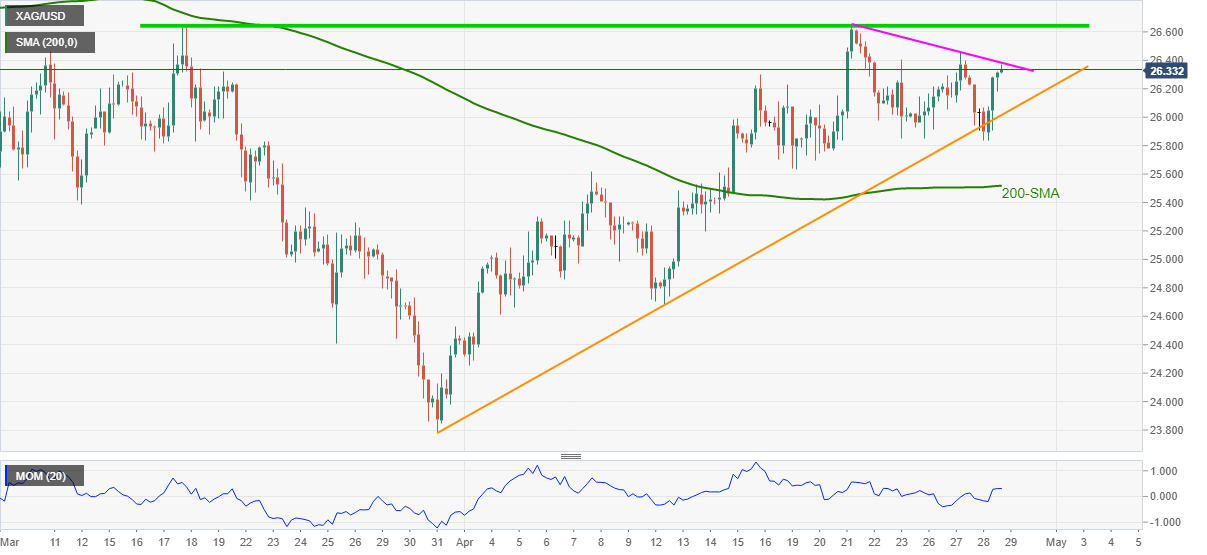

Silver Price Analysis: Buyers attack weekly resistance line above $26.00

- Silver stays bid near intraday top, prints heaviest gains since Monday.

- Upbeat Momentum, sustained trading beyond monthly support line favor bulls.

- A six-week-old horizontal area becomes the key hurdle to the north.

Despite recently easing from an intraday high, silver prices print 0.56% gains on a day during Thursday’s Asian session. In doing so, the white metal battle a downward sloping trend line from April 21.

Given the metal’s multiple bounces off an ascending support line from March 18, silver is likely to pierce the $26.40 immediate hurdle.

However, the quote’s further upside will be stopped by a $26.60-65 resistance area that holds the key to silver’s rally towards March month high near $27.10.

Alternatively, pullback moves need to refresh the weekly low of $25.83 to recall silver sellers.

Following that, the 200-SMA level of $25.51 and April 13 low near $24.70 becomes the key to watch.

Overall, silver prices remain in an upward trajectory but pullback moves can’t be ruled out.

Silver four-hour chart

Trend: Further upside expected