Back

31 May 2021

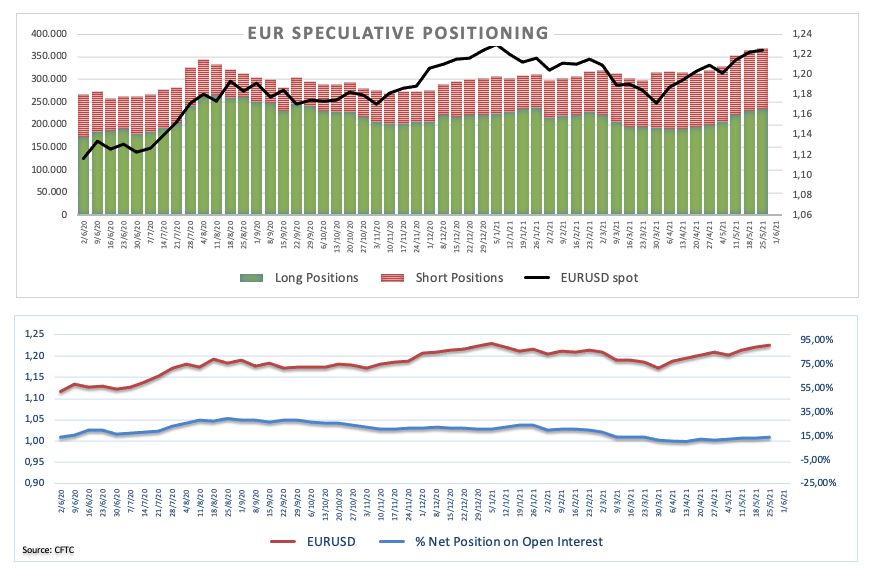

CFTC Positioning Report: EUR net longs at 2-month highs

These are the main highlights of the CFTC Positioning Report for the week ended on May 25th:

- Speculators added gross longs in EUR for the sixth consecutive week and lifted the net longs to the highest level since early March. The softer note in the greenback coupled with optimism on the recovery in the Old Continent and the firm vaccine rollout continued to support inflows into the European currency.

- Net longs in USD clinched multi-week highs following a marginal increase in both gross longs and shorts. The reinforced mega-accommodative stance from the Fed pushed back expectations on tapering and left the US economic recovery narrative as the almost exclusive driver underpinning the buck.

- The safe haven JPY regained some attention following the pick-up in coronavirus cases in Japan followed by fresh restrictions in the activity. That said, net shorts eased a tad to the lowest level in the last couple of weeks. Still in the safe have universe, CHF net shorts shrunk to 4-week lows.

- Net longs in Gold climbed to levels last seen in late February following the lack of traction in US yields and the bearish note surrounding the dollar.

- Net shorts in the VIX (aka “the panic index”) dropped to the lowest level since mid-June 2020, while the index retreated to the area last traded in February of 2020 near 16.00.