US Dollar Index clings to gain above 90.00

- DXY looks to reverse Friday’s post-Payrolls pullback.

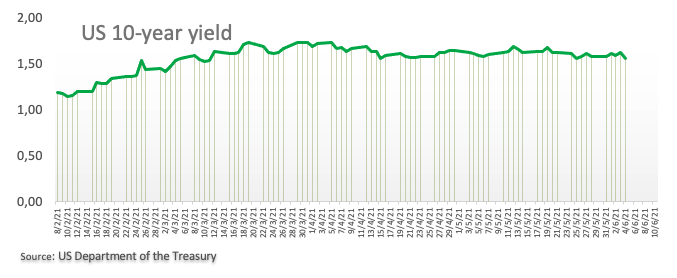

- US 10-year yields start the week with small gains near 1.57%.

- The Fed will publish the Consumer Credit Change for April.

The greenback looks to reverse Friday’s retracement and begins the week slightly in the positive territory and above the key 90.00 mark when gauged by the US Dollar Index (DXY).

US Dollar Index now looks to data

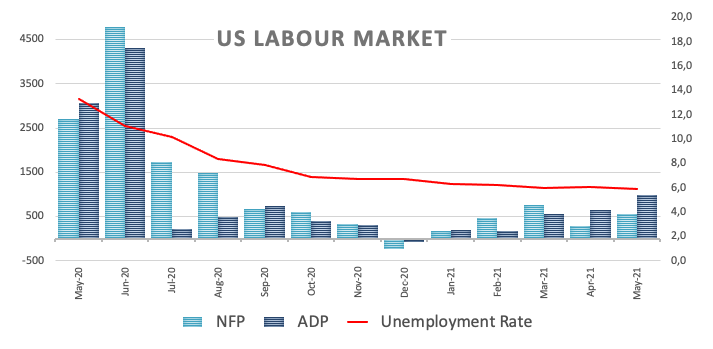

The dollar appears bid at the beginning of the week and retake some ground lost following Friday’s strong pullback in the wake of disappointing Nonfarm Payrolls. It is worth noting that the economy added 559K jobs in May, less than forecasted, while the jobless rate ticked lower to 5.8%. Further data saw Factory Orders also coming in short of estimates, contracting at a monthly 0.6% in April.

US 10-year yields rebound a tad from Friday’s NFP-led lows and navigate around the 1.57%, as market participants continue to digest the recent docket.

In the meantime, the dollar remains under pressure, as the latest Payrolls figures now allow the Fed to buy extra time ahead of any tapering talk. In fact, recent results from the US labour market somewhat reinforces the dovish message from the Fed and sticks to the patient narrative supported by the majority of FOMC members.

On the latter, Cleveland Fed L.Mester (2022 voter, now centrist) advocated for further confirmation from data before any modification of the ongoing asset purchase programme.

Later in the NA session, the Fed will publish the Consumer Credit Change for the month of April, while the focus of attention later this week will be on the inflation figures tracked by the CPI.

What to look for around USD

The index seems to have met a tough barrier in the 90.50/60 band for the time being. Disappointing NFP figures in May now underpin the Fed’s narrative that it is still premature to start the tapering talk. In spite of the recent strength in the dollar, the outlook for the currency remains on the negative side in the longer run. This view stays supported by the perseverant mega-dovish stance from the Federal Reserve (until “substantial further progress” in inflation and employment is made) in place for the foreseeable future and rising optimism on a strong global economic recovery.

Key events in the US this week: Consumer Credit Change (Monday) - Balance of Trade (Tuesday) – Inflation figures tracked by the CPI, Initial Claim (Thursday) – Flash June Consumer Sentiment.

Eminent issues on the back boiler: Biden’s plans to support infrastructure and families, worth nearly $6 trillion. US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Could US fiscal stimulus lead to overheating?

US Dollar Index relevant levels

Now, the index is gaining 0.08% at 90.20 and a breakout of 90.62 (weekly high Jun.4) would open the door to 90.90 (weekly high May 13) and finally 91.05 (100-day SMA). On the other hand, the next contention emerges at 89.53 (monthly low May 25) followed by 89.20 (2021 low Jan.6) and then 88.94 (monthly low March 2018).