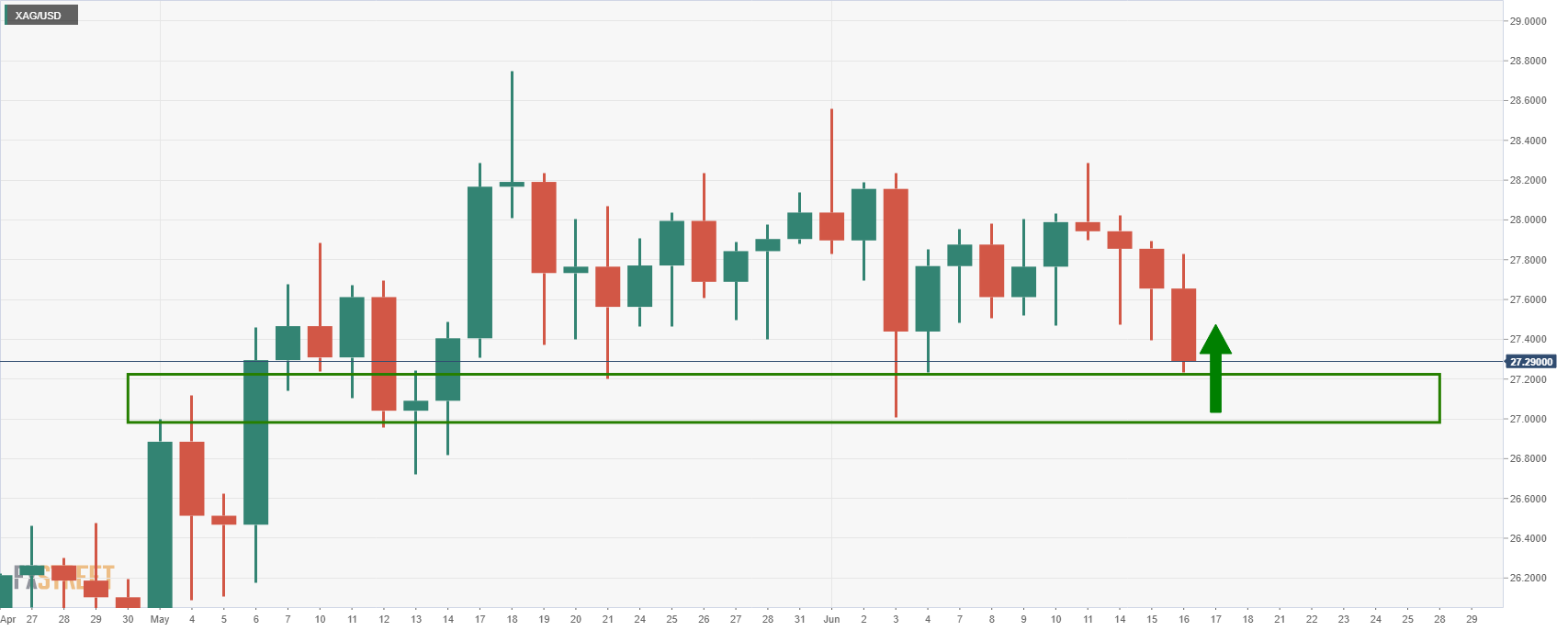

Silver Prices correcti 50% from post Fed lows and fall again

- Silver prices have been beaten up following a hawkish twist at the Fed.

- Bulls are stepping in for some low hanging fruit as markets digest conflict between transitory vs Fed's uncertainty.

The US dollar bulls have been rescued on Wednesday following a hawkish surprise in the Federal reserve's interest statement.

Precious metals have suffered a major blow as a consequence. Both gold and silver have fallen to their lowest levels in a while with the price of XAG/USD down some 0.89% at the time of writing, after plummeting from a pre-Fed high for the day of $27.83 to a low of $27.27.

The US Federal Reserve turned more hawkish as they monitor inflation risks that could turn out to be higher and more persistent than they had expected.

Key notes from the Fed event

- Benchmark interest rate unchanged; target range stands at 0.00% - 0.25%.

- The interest rate on excess reserves raised to 0.15% from 0.10%

- The median projection shows two hikes in 2023, which suggests FOMC has overall shifted more hawkish.

- US Fed funds futures price in a full rate hike by April 2023.

- Powell speech: We are on path to very strong labor market

- Powell speech: Substantial further progress still a ways off

- Powell speech: Conditions for liftoff forecast to be met sooner than previously thought

- Powell speech: Prepared to adjust policy if inflation expectation moved too high

- Powell speech: Would expect strong job creation in summer, going into fall

- Powell stands back on inflation will move down and is temporary.

Markets are now awaiting the August Jackson Hole and with there being prospects of a taper announcement, it will be regarded as one of, if not THE most important event for financial markets this year.

However, there has been an air of caution around the outlook at the Fed and being too bullish on the greenback.

For instance, while the statement took a more upbeat tone on the recovery there was no more convincing detail on the inflation outlook than before.

The previously used line ''it is largely transitory'', remains at the forefront of the Fed, so, there is something for both the bears and the bulls.

The price of the US dollar and, subsequently, silver has corrected following the Fed's chairman, Jerome Powell's press conference where, to some degree, talked down the hawkish reaction to the statement.

For instance, Powell says, short term prices, such as gasoline prices, are not a good forecast for future and longer-term expectations.

Powell also expressed and repeated that the dots are ''not a great forecaster''.

-

Powell speech: Discussing lift off now would be highly premature

This could give rise to a significant correction in the greenback over the coming sessions and throw the silver bulls a life-line from the daily demand area: