GBP/USD firmer in a risk-on environment, BoE Saunders eyed

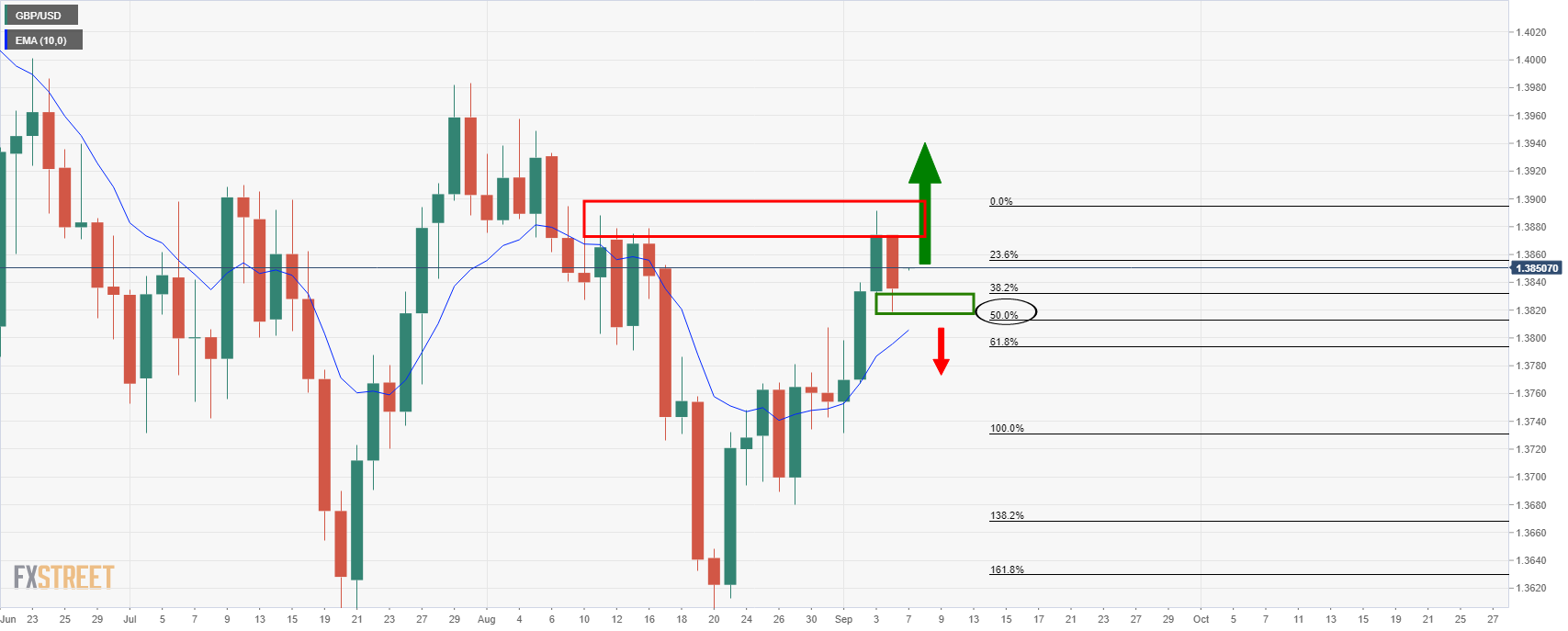

- GBP/USD bulls are pressured to a 38.2% Fibonacci retracement level.

- Traders will be on the watch for hawkish rhetoric from BoE officials.

GBP/USD is trading slightly bid in Tokyo as risk recovers following a soured start to the week following a dismal US Nonfarm Payrolls outcome.

The data reflects the possibility that the global economy is on the verge of a significant slowdown.

That coupled with the Chinese data of late missing the mark, investors are concerned that the spread of the delta variant is about to take its toll.

The pound has been regarded as a risk currency due to its twin deficits, so it has done well at times of risk-on and vice versa.

Tomorrow, full markets will return in North America and the full extent of the global recovery concerns will likely be reflected in the price action on Wall Street's stock and money markets.

Meanwhile, traders now await further cues on the British economy and the Bank of England's future policy direction.

IHS Markit's construction Purchasing Managers' Index (PMI) showed the UK construction industry grew last month at its weakest pace since the lockdown of early 2021, hit by a severe shortage of building supplies.

Friday PMI data had shown growth in the services sector slowed down in August compared with July.

The data not only reveal concerns over the covid lockdowns, but Brexit and other global supply chain issues.

Nonetheless, growth data due on Friday will be watched just as political angst starts to come back to the fore.

Prime Minister Boris Johnson's plan to hike taxes to fund social care is causing issues within his own cabinet.

Nevertheless, this has little bearing on the pound for the moment and instead, the focus stays on the Bank of England's next move.

There are expectations that inflation will rise which makes this Tuesday's speech from Michael Saunders one to watch.

Saunders is a member of the Monetary Policy Committee and he has advocated for an early end to the Old Lady's 895-billion-pound asset purchase programme.

The pound might get a lift if he stands on the selfsame rhetoric.

GBP/USD technical analysis

The bulls are on the verge of a move higher from the 38.2% Fibonacci retracement level, although it might be slightly premature, requiring the bears to fully capitulate first.

Should they not, then a downside continuation to pressure the 21-day EMA would be expected in a deeper correction over the coming days.