Gold Price Forecast: Fed's hawkish tone marred by risk-on sentiment

- Fed leaves interest rates unchanged says moderation in asset purchases "may soon be warranted".

- Gold volatile on the FOMC statement and rallies into daily resistance.

The price of gold has been volatile on Wednesday following the Federal Reserve's interest rate decision that has just been released.

XAU/USD has rallied to a fresh high of $1,786.87 in a 1% move between $1,769 and $1,787.87 so far. The FOMC statement gives rise to an imminent taper announcement.

Key takeaways, first glance

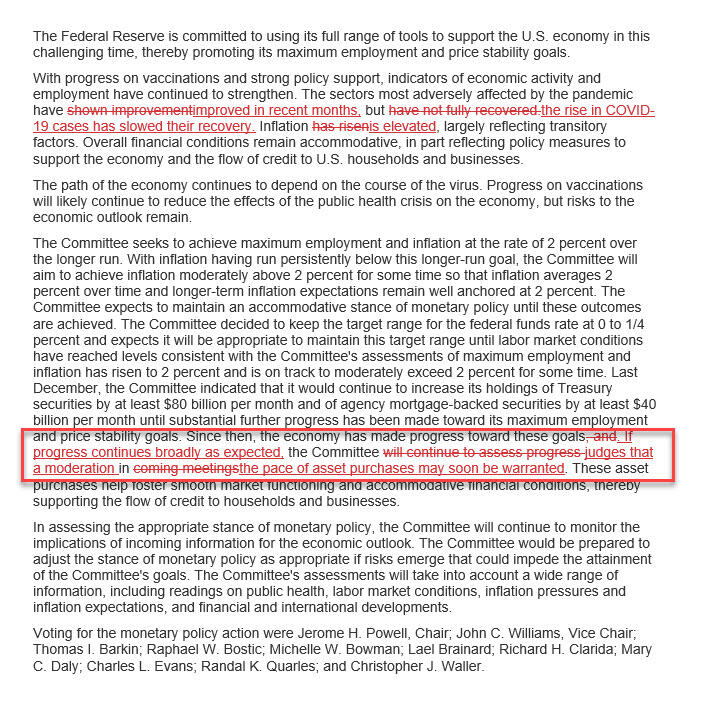

Fed leaves interest rates unchanged.

The Fed says moderation in asset purchases "may soon be warranted".

If progress continues as expected, a taper may soon be warranted.

Dots suggest that Fed has signalled that it may start raising its benchmark interest rate sometime next year.

Hawkish changes on the statement:

The Fed funds futures raise chances of a Fed rate hike by Dec 2022 to more than 80% following this and earlier than it envisioned three months ago and a sign that it's concerned that high inflation pressures may persist.

The US dollar would be expected to find demand on this development. So far, however, the DXY is lower on the day by some 0.11%.

The Evergrande risk that is abating is giving rise to a risk-on environment, hece risk assets remain supported despite the Fed's hawkish tone.

All eyes on Fed Powell

Federal Reserve chairman's press conference. Jerome Powell will be answering questions likely related to the Evergrande risks and timings of tapering as well as inflation and economic outlooks.

Expect further volatility.

Watch live, Fed's chair Powell

Gold technical analysis

Gold has in the throws of the Wycoff breakout and reaccumulation phase as pointed out in yesterday's analysis as follows:

''The price is playing out in a typical Wycoff post accumulation phase. The bulls broke out of the accumulation zone highs of $1,767 and in a strong rally which would be expected to correct where it met a psychological $1,780 short-term target level. A subsequent correction would be expected to be followed by another bullish impulse towards $1,790 for the sessions ahead on Wednesday. ''

Live market