US Dollar Index climbs to new cycle tops near 97.40

- DXY keeps the Fed-led rally well and sound above 97.00.

- US yields resumes the upside across the curve on Friday.

- PCE, U-Mich Index next of relevance in the US calendar.

The greenback, in terms of the US Dollar Index (DXY), pushes higher and reaches new highs around 97.40 at the end of the week.

US Dollar Index now looks to data

The index advances uninterruptedly since Monday and clinches new peaks in the 97.40 region, levels last traded back in July 2020.

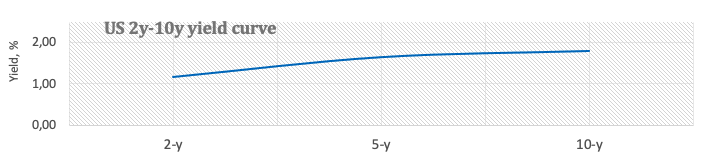

The daily improvement in the buck comes against the backdrop of the better mood in US yields, with the short term of the curve surpassing the 1.21% mark to nearly 2-year peaks, the belly following suit near 1.83% and the long end navigating in the upper end of the last 7-month range around 2.13%. The ongoing bear flattening of the curve has been exacerbated following the hawkish tilt at the FOMC meeting on Wednesday.

The prospects of a faster and maybe stronger pace of the Fed’s tightening flagged at the last meeting sponsored a noticeable exodus from the risk complex and into the dollar, which in turn morphed into extra oxygen for the DXY.

Later in the US data space, the focus of attention will be on the inflation figures measured by the PCE seconded by the final print of the Consumer Sentiment for the current month and Personal Income/Spending during December.

What to look for around USD

The index regained extra pace following the hawkish message at the FOMC gathering and pushes the greenback to new tops past the 97.00 barrier. Meanwhile, the constructive outlook for the greenback is expected to remain unchanged for the time being on the back of rising yields, persistent elevated inflation, supportive Fedspeak and the solid pace of the US economic recovery.

Key events in the US this week: PCE, Personal Income/Spending, Final Consumer Sentiment (Friday).

Eminent issues on the back boiler: Fed’s rate path this year. US-China trade conflict under the Biden administration. Debt ceiling issue. Escalating geopolitical effervescence vs. Russia and China.

US Dollar Index relevant levels

Now, the index is gaining 0.17% at 97.37 and a break above 97.42 (2022 high Jan.28) would open the door to 97.80 (high Jun.30 2020) and finally 98.00 (round level). On the flip side, the next down barrier emerges at 96.05 (55-day SMA) seconded by 95.41 (low Jan.20) and then 94.62 (2022 low Jan.14).