Back

14 Feb 2022

Crude Oil Futures: Probable correction on the cards

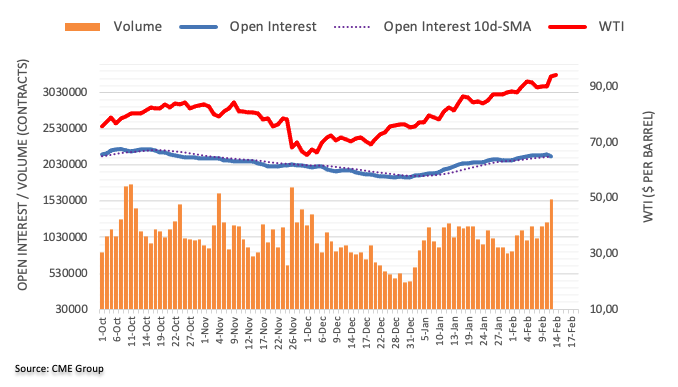

CME Group’s preliminary readings for crude oil futures markets note traders scaled back their open interest positions by around 19.3K contracts at the end of last week. Volume, instead, rose for the third session in a row, this time by around 328.2K contracts, the largest single-day build since November 26 2021.

WTI looks overbought, targets $100/bbl

Friday’s important uptick in prices of the WTI was on the back of shrinking open interest, hinting at the idea that a corrective move could be in the offing in the very near term. This view is supported by the overbought condition of the commodity, as the RSI hovers around the 75.00 level. The rally in crude oil, in the meantime, now shifts the attention to the psychological $100.00 mark per barrel.