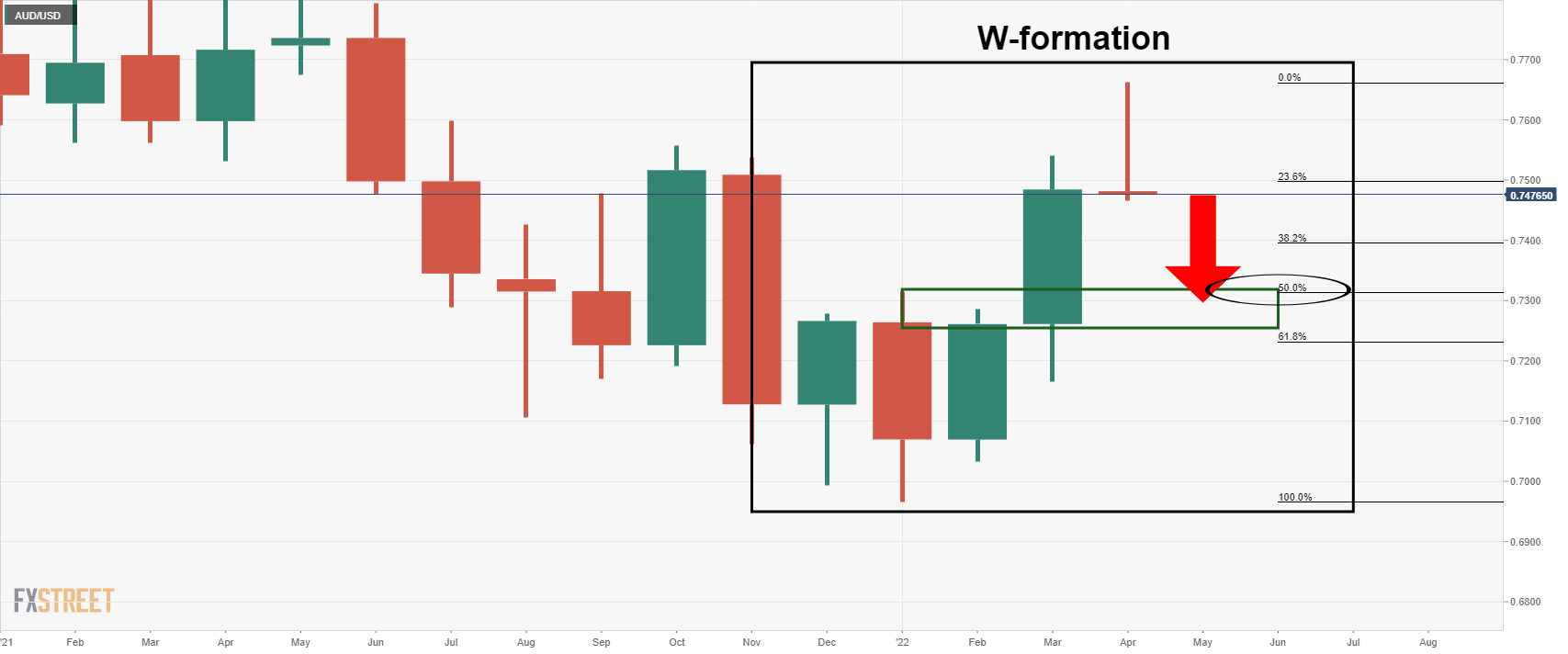

AUD/USD bulls failing at weekly resistance, 50% reversion eyed

- AUD/USD bears stepping in as the bulls throw in the towel.

- Bears eye the 50% monthly mean reversion level in the W-formation.

AUD/USD remains pressured into the closing session so the week as a firm US dollar persists surrounding the hawkish US central bank narrative. After sliding from a high of 0.7518, at 0.7478, during the time of writing, AUD/USD is losing some 0.37% and is in close proximity to the day's lows at 0.7466.

AUD/USD has been driven back by the bears this week following a brief spell up at 0.7661. These were the highest levels seen since June 2021 and were reached on the back of a hawkish twist at the Reserve Bank of Australia. ''Just as the Aussie lost some of its commodity price support, the RBA discarded its 'patient' outlook, stoking a fresh wave of yield support for the currency,'' analysts at Westpac explained. ''Yet 10-month highs were soon reversed as hawkish Fed rhetoric ratcheted up even further.''

We have a series of Fed hawkish themes this week that started with a speech from Lael Brainard who said Tuesday that the central bank could start reducing its balance sheet as soon as May and would be doing so at “a rapid pace.”

She also indicated that interest rate hikes could come at a more aggressive pace than the typical increments of 0.25 percentage points. The central bank has already increased rates in a 0.25% hike at the March meeting, the first in more than three years and likely one of many to occur this year.

Then along came the Fed minutes on Wednesday. In these, it was noted by the markets that the Fed officials reached consensus at their March meeting that they would begin reducing the central bank balance sheet by $95 billion a month, likely beginning in May. The minutes also underpinned a notion that 50 basis point interest rate increases are ahead.

On Thursday, St. Louis Fed president James Bullard added to the hawkishness by saying that the Fed remains behind the curve despite increases in mortgage rates and government bond yields. As a consequence, the US dollar is rallying and has reached fresh two-year highs as measured by the DXY index.

At the time of writing, DXY is trading at 99.780, a touch below the highs of 99.821 from the lows of 99.399. The 25 May 2020 weekly highs are located at 99.975. Next week's US inflation data seems likely to keep the US dollar on the boil as well.

AUD/USD monthly chart

As per the prior longer-term analysis, AUD/USD Price Analysis: Bulls coming up for their last breath?, while the October highs were broken, they have not been ''well and truly cleared''. Therefore, the Monthly W-formation, a reversion pattern, remains in the picture: